40 what is zero coupon bonds

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. How to Invest in Zero-Coupon Bonds | Bonds | US News The problem can be avoided with a tax-free municipal zero-coupon bond, or by holding the zero in a tax-preferred account like an individual retirement account. Volatility is a second issue.

What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is different from other bonds in that it doesn't result in recurring interest income for the bondholder. Instead, the owner buys the bond at a discount. Then when the bond reaches maturity, the profit for the investor is the difference between the purchase price of the bond and its face value (aka par value). The investor ...

What is zero coupon bonds

What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond. When the bond reaches maturity, its investors receive its par (or face ... Zero Coupon Bonds- Taxability under Income Tax Act, 1961 The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - "Zero Coupon bond" means a bond: - (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005 (b) in respect of which no payment and benefit ... Zero Coupon Bonds Explained (With Examples) - Fervent | Finance Courses ... The only thing they do pay is the Par (aka "face value") when the bond matures. Put differently, a zero coupon bond is a bond that doesn't pay any interest. Instead, it only pays a lump-sum payment at the end of the bond's life. That is, at its maturity or expiration date; i.e., the date when the bond matures or expires.

What is zero coupon bonds. What Is a Zero-Coupon Bond? Definition, Characteristics & Example For instance, if a zero-coupon bond was sold at a $100 discount and matures in four years, its holder would have to pay the applicable bond interest tax rate on $25 worth of the bond's total $100 ... Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are commonly issued by governments. In this article, we will have a closer look at the pros and cons of zero-coupon bonds from an investor's point of view: Pros of Zero-Coupon Bonds. There are many zero-coupon bonds that are already in existence. Also, each year, many new zero-coupon bonds are issued. Despite there being so ... efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. › tcir › tcir_zerocouponGovernment - Continued Treasury Zero Coupon Spot Rates* Aug 14, 2013 · IRS Tax Credit Bonds Rates; Treasury's Certified Interest Rates. Federal Credit Similar Maturity Rates. ... (Zero Coupon) Rates” on the following website: ...

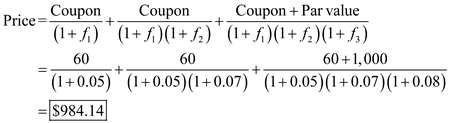

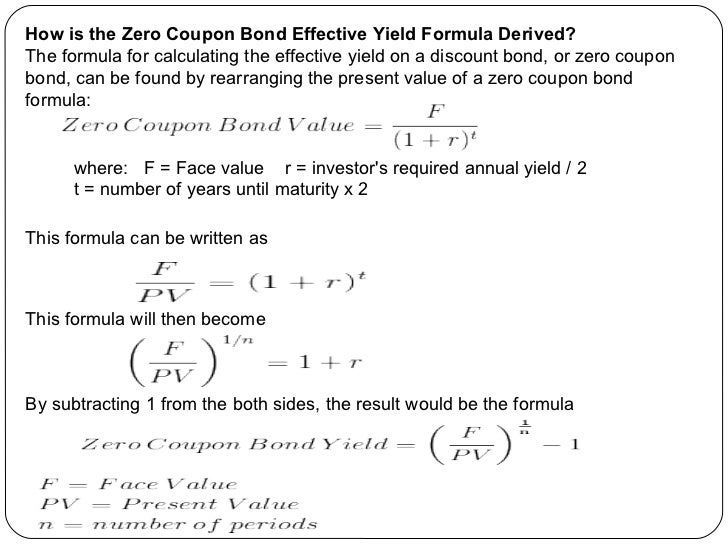

Zero Coupon Bond - Explained - The Business Professor, LLC Calculating the Price of a Bond. Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs ... What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder. open.lib.umn.edu › financialaccounting › chapter14.3 Accounting for Zero-Coupon Bonds – Financial Accounting Explain how interest is earned on a zero-coupon bond. Understand the method of arriving at an effective interest rate for a bond. Calculate the price of a zero-coupon bond and list the variables that affect this computation. Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term "compounding."

Should I Invest in Zero Coupon Bonds? | The Motley Fool Zero coupon bonds are therefore sold at a discount to their face value. So for instance, a 10-year zero coupon bond priced when prevailing yields were 3% would typically get auctioned for roughly ... corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ... Zero-Coupon Bond: Formula and Excel Calculator Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a "T-Bill," a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Zero-Coupon Bond Price Formula.

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at maturity. The amount paid at maturity is called the face value.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000.

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

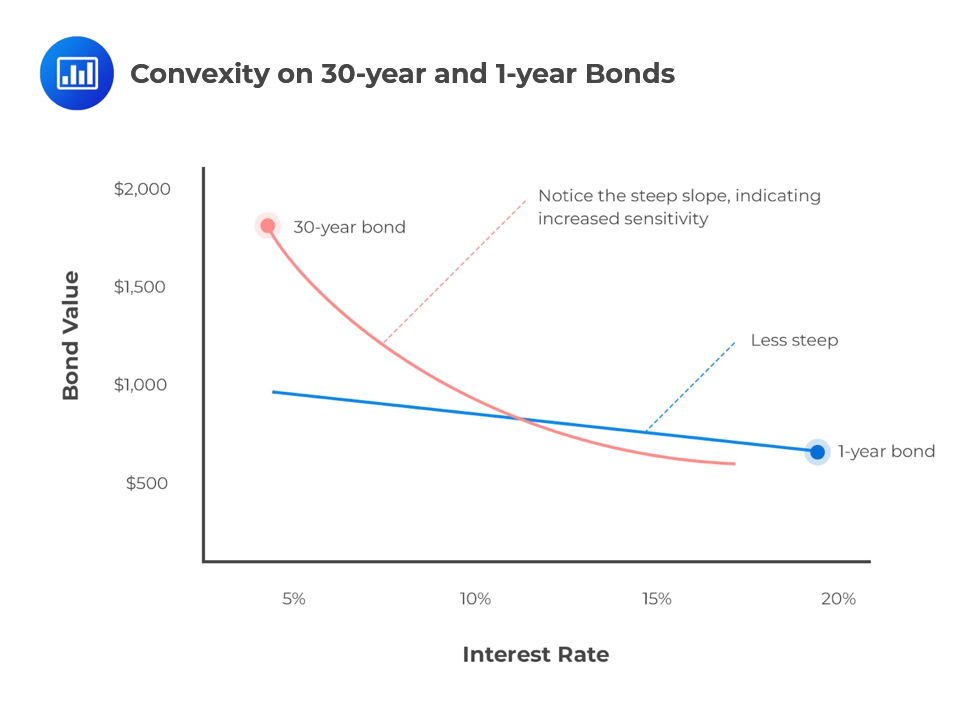

Zero-coupon bond financial definition of Zero-coupon bond A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value. Zero-coupon bonds are subject to very large price fluctuations.

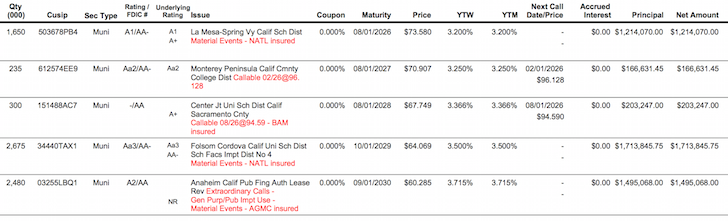

Solved Zero-coupon bond. Addison Company will issue a | Chegg.com What is the price of the bond using a. Question: Zero-coupon bond. Addison Company will issue a zero-coupon bond this coming month. The bond's projected yield is 3%. If the par value is $5,000, what is the bond's price using a semiannual convention if a. the maturity is 20 years? b. the maturity is 35 years?

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ...

› bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ...

› terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ...

Zero Coupon Bonds Explained (With Examples) - Fervent | Finance Courses ... The only thing they do pay is the Par (aka "face value") when the bond matures. Put differently, a zero coupon bond is a bond that doesn't pay any interest. Instead, it only pays a lump-sum payment at the end of the bond's life. That is, at its maturity or expiration date; i.e., the date when the bond matures or expires.

Zero Coupon Bonds- Taxability under Income Tax Act, 1961 The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - "Zero Coupon bond" means a bond: - (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005 (b) in respect of which no payment and benefit ...

What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond. When the bond reaches maturity, its investors receive its par (or face ...

Post a Comment for "40 what is zero coupon bonds"