44 coupon rate formula calculator

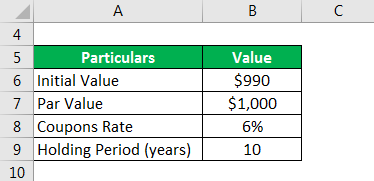

How To Calculate YTM (Years To Maturity) On A Financial Calculator N = number of payments per year A = interest payment per year PV = present value of the bond FV = face value of the bond n = number of years until maturity For example, let's say you have a 10-year $1,000 bond with an 8% coupon rate. The interest payments would be $80 per year (8% of $1,000), and the face value of the bond is $1,000. Labor Cost Calculator | Definition | Example | Formula Labor cost example. Assume workers work 40 hours per week and earn $13 per hour. In addition, they will get $100 in fringe benefits and $50 in payroll taxes. To obtain 3.75, multiply the total of the benefits and taxes (100+50) by 40. After adding $3.75 to $13, the hourly rate comes to $16.75.

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the percentage of an issued security's face value that is paid out as interest by the issuer. The formula for calculating a bond's coupon rate is: \text {Coupon Rate} = \frac {\text {Coupon Payments}} {\text {Face Value}} The coupon rate is often expressed as a percentage, but it can also be expressed in decimal form.

Coupon rate formula calculator

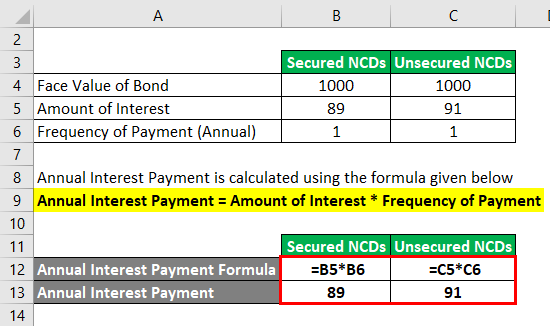

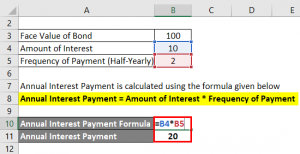

Bond Yield: Definition & Calculation with Interest Rates Coupon rate: the bond's interest rate which is a percentage of the bond's face value; for example, if a bond has a coupon rate of 5% and a face value of $1,000, it will pay $50 in interest annually How to Calculate Coupon Rate in Excel (3 Ideal Examples) The coupon rate is calculated by dividing the Annual Interest Rate by the Face Value of Bond. The result is then expressed as a percentage. So, we can write the formula as below: Coupon Rate= (Annual Interest Rate/Face Value of Bond)*100 3 Ideal Examples to Calculate Coupon Rate in Excel Difference Between Coupon Rate and Discount Rate Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond.

Coupon rate formula calculator. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder. Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. How to Calculate the Average Price (With Formula and Steps) Here's the formula you can use to calculate VWAP: Volume-weighted average price = (Cumulative typical stock price x Volume of stocks) / Cumulative volume of stocks. ... An investor purchases a bond with a coupon rate of 6% and five years to maturity for $1,200. With a face value of the bond of $1,000, the investor calculates the annual 6% ... Discount Calculator - Find Out the Sale Price Divide the new number by the pre-sale price and multiply it by 100 (In D1, input = (C1/A1)*100) and label it "discount rate". Right click on the final cell and select Format Cells. In the Format Cells box, under Number, select Percentage and specify your desired number of decimal places. How do I find the original price?

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Prompt Payment: Discount Calculator Discount Calculator Form. Fields marked with an asterisk are required. Discount the vendor is offering: Enter as a decimal. For example, for 2.8% enter .028 Total Days in the Payment Period: Days Left in the Discount Period: Current Value of Funds Rate: The rate in the box is the current rate. The current rate if 1%, entered in the box as the ... Bond Pricing | Valuation | Formula | How to calculate with example | eFM Example 2. Calculate the price of a bond whose face value is $1000. The coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8. Preferred Stock - YTC Calculator Click the Year to select the Call Date, enter coupon call and latest price then Calculate.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of the bond. The par value of a bond is the amount that the issuer agrees to repay to the bondholder at the time of maturity of the bond. In formula it can be written as follows: Coupon = Coupon Rate X Par Value Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate of ABZ, the steps discussed in the coupon rate formula should be followed. Identify the par value of the bond: In this example, ABZ is issuing bonds with a $1,000 par ... Compound Interest Formula With Examples - The Calculator Site t = the time the money is invested for. Example: Let's say your goal is to end up with $10,000 in 5 years, and you can get an 8% interest rate on your savings, compounded monthly. Your calculation would be: P = 10000 / (1 + .08/12) (12×5) = $6712.10. So, you would need to start off with $6712.10 to achieve your goal. How to Calculate Bond Price in Excel (4 Simple Ways) In the formula, rate = F8, nper = F7, pmt = F5*F9, [fv] = F5. 🔄 Semi-Annual Coupon Bond In cell K10 insert the following formula. =PV (K8/2,K7,K5*K9/2,K5) In the formula, rate = K8/2 (as it's a semi-annual bond price), nper = K7, pmt = K5*K9/2, [fv] = K5.

Rate of Return Calculator We can compute the rate of return in its simple form with only a bit of effort. In this case, you don't need to consider the length of time, but the cost of investment or initial value and the received final amount. rate of return = (final amount received - initial value) / initial value

Calculating Tax Equivalent Yield on Municipal Bonds Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%.

Price of a Zero coupon bond - Calculator - Finance pointers The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below insert the values of Face value / Maturity value of the zero coupon bond, Discount ...

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Zero Coupon Bond Yield: Formula, Considerations, and Calculation The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Difference Between Coupon Rate and Interest Rate The simple interest is calculated by multiplying the principal amount with the annual interest rate and term of the loan over the years. Meanwhile, compound interest is by multiplying principal amount with (1+ annual rate interest) and term of the loan in years.

Compound Interest Calculator - NerdWallet We started with $10,000 and ended up with a little more than $500 in interest after 10 years in an account with a 0.50% annual yield. But by depositing an additional $100 each month into your ...

RATE Function - Formula, Examples, How to Use RATE Function For a financial analyst, the RATE function can be useful to calculate the interest rate on zero coupon bonds. Formula =RATE (nper, pmt, pv, [fv], [type], [guess]) The RATE function uses the following arguments: Nper (required argument) - The total number of periods (months, quarters, years, etc.) over which the loan or investment is to be paid.

How to Perform Bond Valuation with Python - Medium The YTM of the bond is about 7.89%. Since the bond coupon rate (5%) is less than its YTM, the bond is selling at a discount. On another hand, if the coupon rate is more than its YTM, the bond is selling at a premium. YTM is useful for an investor to determine if a bond is purchased with a good deal.

Difference Between Coupon Rate and Discount Rate Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond.

How to Calculate Coupon Rate in Excel (3 Ideal Examples) The coupon rate is calculated by dividing the Annual Interest Rate by the Face Value of Bond. The result is then expressed as a percentage. So, we can write the formula as below: Coupon Rate= (Annual Interest Rate/Face Value of Bond)*100 3 Ideal Examples to Calculate Coupon Rate in Excel

Bond Yield: Definition & Calculation with Interest Rates Coupon rate: the bond's interest rate which is a percentage of the bond's face value; for example, if a bond has a coupon rate of 5% and a face value of $1,000, it will pay $50 in interest annually

Post a Comment for "44 coupon rate formula calculator"