38 zero coupon bond semi annual calculator

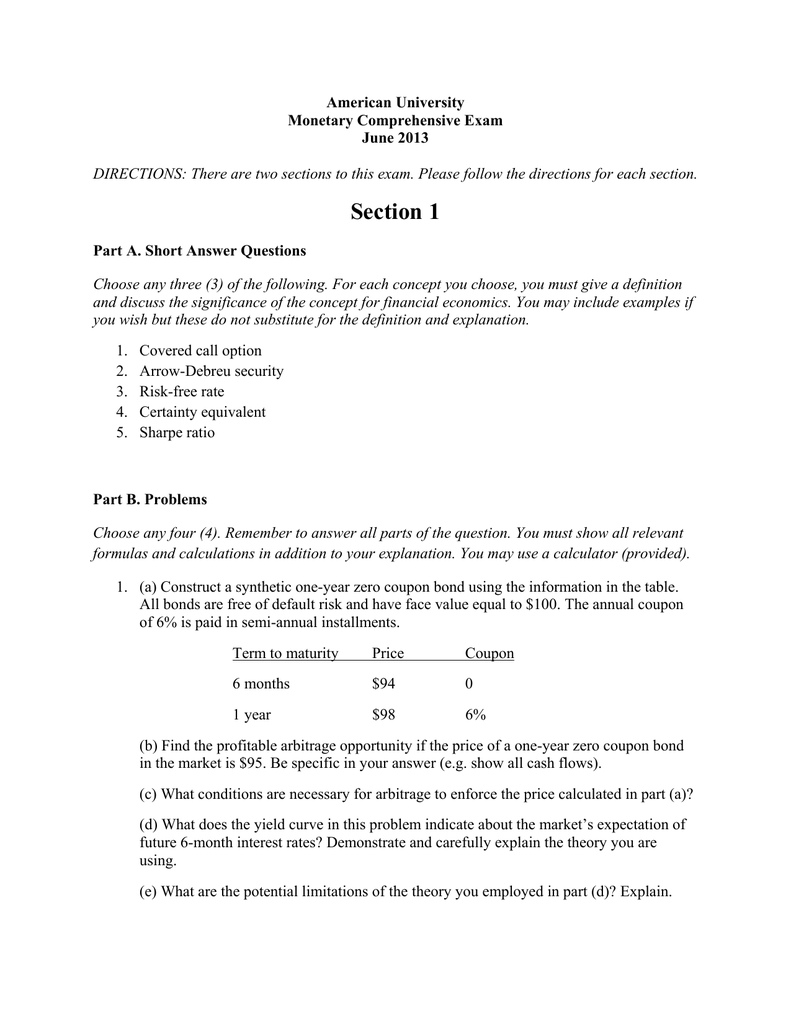

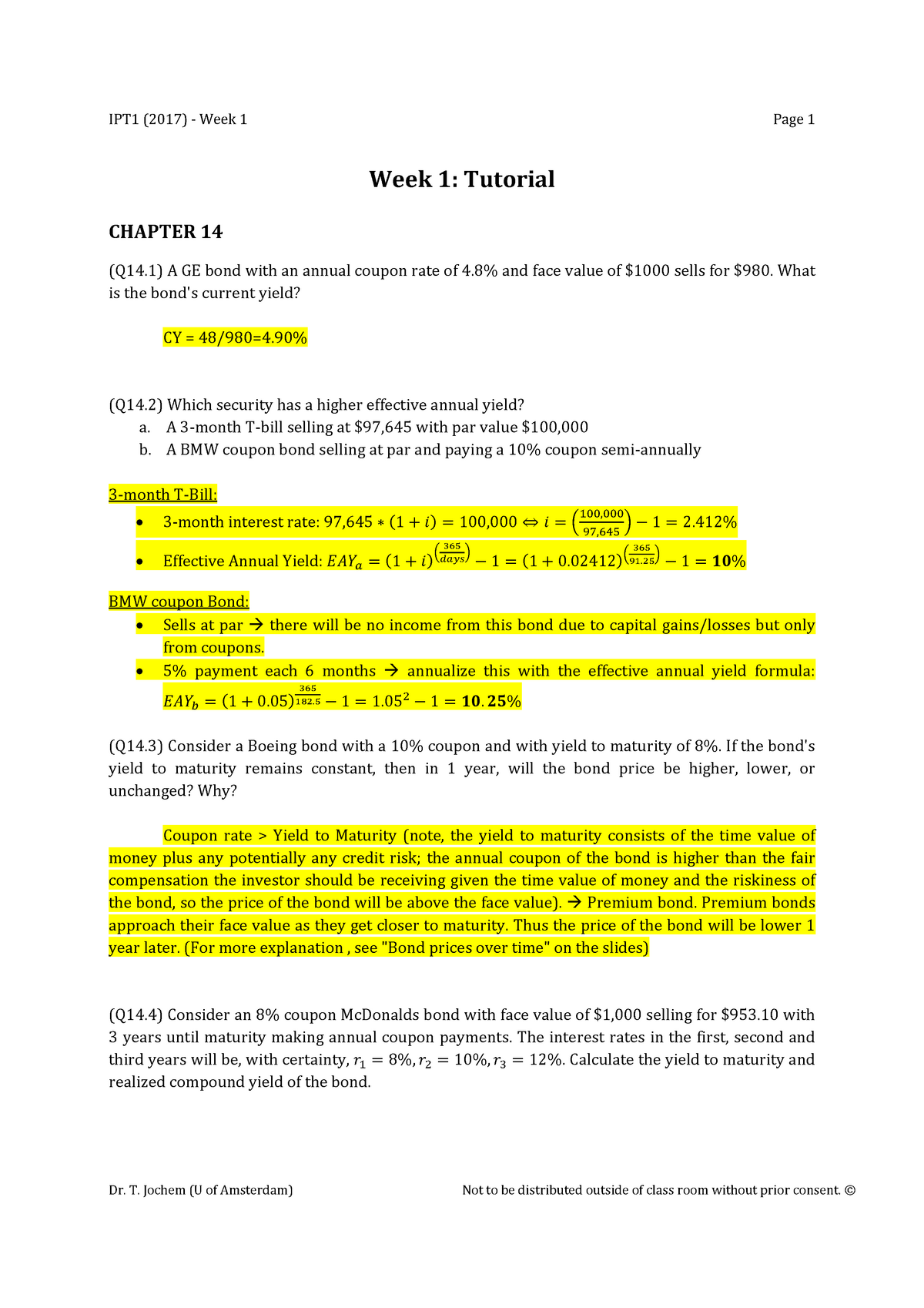

Bond accrued interest calculator - JordanArwen The Calculator is for paper bonds only. 65 simple interest rate. For example if you want to find the interest your paper bonds accrued in 1999 enter 121999 in the Value as of box. Thats the amount of interest your paper bonds accrued that year. The payment of interest for bonds is on an accrual basis. Finance Archive | September 09, 2022 | Chegg.com An investor buys a newly issued annual bond that pays its coupons once a year. The bonds coupon rate is \( 16.75 \% \) its time to maturity is 4 years, and the yield to maturity is \( 12.75 \% \). The. 2 answers ⦁ Gagah Perkasa Berhad is considering two mutually exclusive projects with depreciable lives of three and six years. The after-tax ...

Coupon bond calculator - AmayaTaika A bonds coupon is the interest payment you receive. As this is a semi-annual coupon bond our annual coupon rate calculator uses coupon frequency of 2. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute. Inputs to the Bond Value Tool. Bond face value is 1000.

Zero coupon bond semi annual calculator

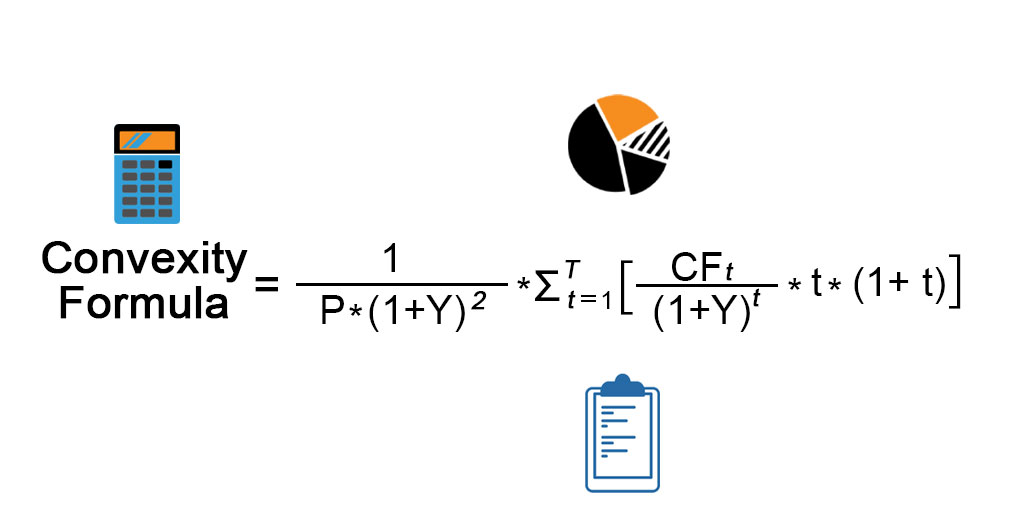

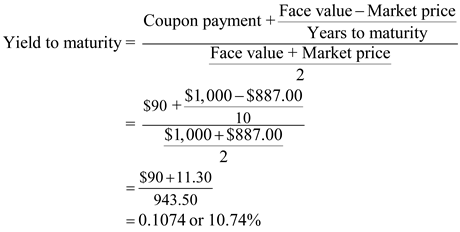

Australia Government Bonds - Yields Curve The Australia 10Y Government Bond has a 3.566% yield.. 10 Years vs 2 Years bond spread is 52.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.35% (last modification in September 2022).. The Australia credit rating is AAA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 27.60 and implied probability of default is 0.46%. FIN 221 Flashcards | Quizlet How can you calculate the future value at year n of a stream of uneven cash flows more rapidly on your financial calculator without finding the FV of each individual CF? ... A 20-year zero coupon bond. ... They pay a $65 annual coupon and have a 15-year maturity, but they can be called in 5 years at $1,100. What is their yield to maturity (YTM › bond-yield-calculatorBond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below:

Zero coupon bond semi annual calculator. › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate bond has a coupon that represents a fixed percentage of its par value. Buying a $1,000 Bond With a Coupon of 10% - Investopedia Most bonds pay interest semi-annually, which means bondholders receive two payments each year. 1 So with a $1,000 face value bond that has a 10% semi-annual coupon, you would receive $50 (5% x... Coupon Decode Give us a call or text @ 1-800-877-4798 Your trusted coupon clipping service since 2011 DIAL BODY WASHES, MEN BODY WASHES, KIDS BODY WASHES OR TONE BODY WASHES, ANY TWO $2.00/2 EXP - 09/25/22 $0.25 Add to Cart Back Market Coupon, Promo Codes: $10 Off - September 2022 - RetailMeNot.com Back Market Coupon, Promo Codes: $10 Off - September 2022 ... Calculate The Ytm Of A Coupon Bond - Otosection Use the below given data for calculation of ytm we can use the above formula to calculate approximate yield to maturity. coupons on the bond will be $1,000 * 8%, which is $80. yield to maturity (approx) = (80 (1000 - 94) 12 ) ( (1000 940) 2) ytm will be - example #2 fannie mae is one of the famous brands that are trading in the us market.

Calculate The Ytm Of A Bond With Semi Annual Coupon Payments In Excel ... With all required inputs complete, we can calculate the semi annual yield to maturity (ytm). semi annual yield to maturity (ytm) = [$30 ($1,000 - $1,050) 20] [ ($1,000 $1,050) 2] semi annual ytm = 2.7% now, for the final step, we must convert our semi annual ytm to an annual percentage rate - i.e. the annualized yield to maturity (ytm). › documents › excelHow to calculate bond price in Excel? - ExtendOffice Calculate price of a semi-annual coupon bond in Excel Calculate price of a zero coupon bond in Excel For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. The Basics of Municipal Bonds - Investopedia Over the past 10 years, the average default rate for investment grade municipal bonds was 0.10%, compared with a default rate of 2.25% for similarly rated corporate bonds. Nevertheless, municipal ... How to Invest in Bonds - The Motley Fool There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year ...

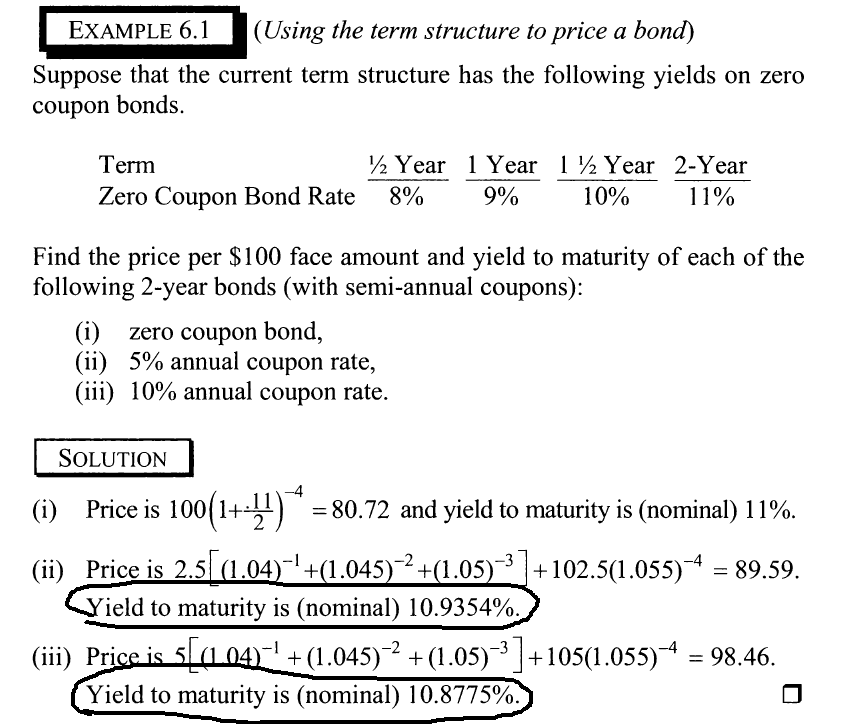

United States Government Bonds - Yields Curve The United States 10Y Government Bondhas a 3.325%yield. 10 Years vs 2 Years bond spreadis -22.8 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rateis 2.50%(last modification in July 2022). The United States credit rating is AA+, according to Standard & Poor's agency. How to Calculate Bond Price - myagropowell.blogspot.com To calculate the current yield of a bond in Microsoft Excel enter the bond value the coupon rate and the bond price into adjacent cells eg A1 through A3. Since the bonds coupon is only 50 the market price must fall to 500 when the interest rate is 10 to be. To calculate a value you dont need to enter a serial number. Treasury Rates, Interest Rates, Yields - Barchart.com They have a coupon payment every six months like T-Notes, and are commonly issued with maturity of thirty years. The secondary market is highly liquid, so the yield on the most recent T-Bond offering was commonly used as a proxy for long-term interest rates in general. (1) (1) Source: Wikipedia. Canadian Treasury Rates Bond Valuation - brainmass.com Bond pricing using zero coupon bonds, A 7% annual coupon bond (face value $1,000), with three years left till maturity is selling for $986.90. Zero-coupon bonds of 1, 2, 3 years maturity (all with face value of $1,000) sell for $950, $900, $820,respectively.

China Government Bonds - Yields Curve The China 10Y Government Bond has a 2.652% yield. 10 Years vs 2 Years bond spread is 62.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.65% (last modification in August 2022). The China credit rating is A+, according to Standard & Poor's agency.

My Best Coupon Deals are zero coupon bonds always semi annual; art on the rocks coupon; art science museum promo code; ashley furniture 10 off code; ... zero coupon bond semi-annual pounding calculator; zomato coupon on first order; zoro coupon october 2016; zoro tools coupon code december; Show more Show less.

Excel Calculating The Price Of An Annual Coupon Bond Youtube Calculate the market price of the bonds based on the given information. solution: coupon (c) is calculated using the formula given below. c = annual coupon rate * f c = 5% * $1000 c = $50 coupon bond is calculated using the formula given below. coupon bond = c * [1 - (1 y n) n*t y ] [ f (1 y n)n*t].

Factsheet | BS22114E; SITB ZERO 24Jan2023 Govt (SGD) Bond Charges, 0.1% of nominal value for each buy/sell order, subject to a minimum of SGD10 and GST. Processing Fee, 0.025% per quarter, calculated on a daily average market value of bonds, subject to GST. Platform Fee, Bond Calculator, Nominal Value, Buy at, Market Order, SGD, What You Pay, 0.00, Indicative Accrued Interest (SGD) 10.00,

Online Promotional Coup On Code - Blogger As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now kno

Lesson 1: Bond Valuation Flashcards | Quizlet The 1 year bond gives 5% coupon rate. By discounting the interest rate, we can know how much money to invest now to get $1000 next year by $1000/ (1+0.05)= $952.38, discount rate (fed reserves) The interest rate on the loans that the Fed makes to banks, Principle repaid at the end of the loan/bond is called, face value or par value, coupons,

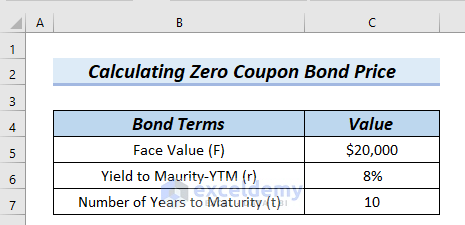

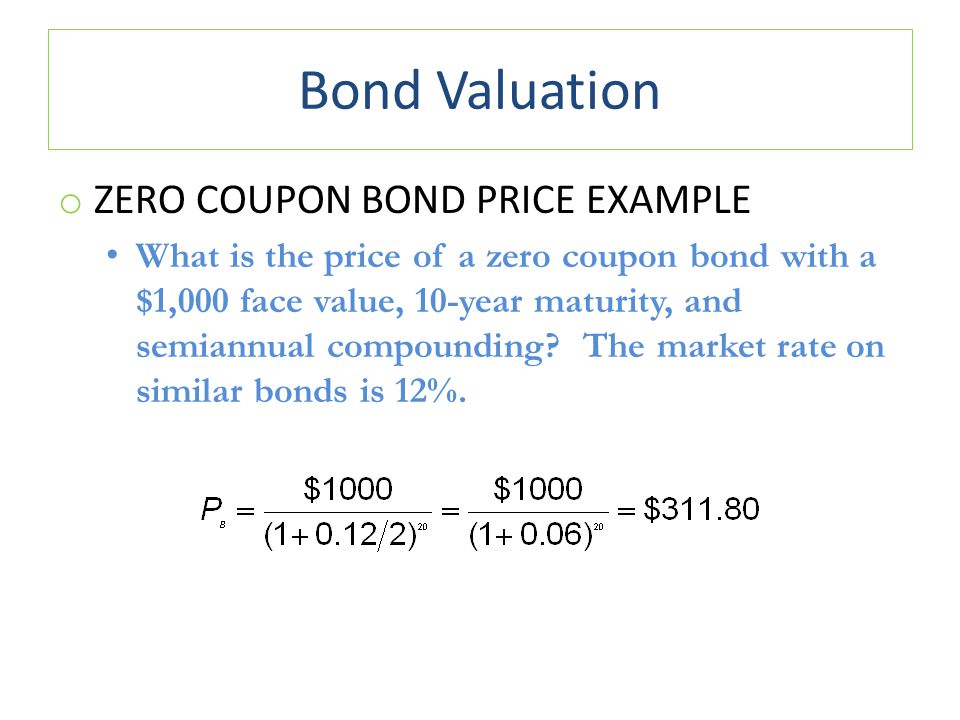

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

Bond compound interest calculator - AllysonGaja This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity. You can learn more about supercharging your retirement. As the prior example shows the value at the 6 rate with 5 years remaining would be 7473.

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.305% yield.. 10 Years vs 2 Years bond spread is 332 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.50% (last modification in July 2022).. The South Africa credit rating is BB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default is 5.23%.

Zero Coupon Bond Value Formula With Calculator - Otosection Zero coupon bond formula. the following formula is used to calculate the value of a zero coupon bond. zcbv = f (1 r)^t. where zcbv is the zero coupon bond value. f is the face value of the bond. r is the yield rate. t is the time to maturity.

goodcalculators.com › bond-yield-to-maturityYield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000.

Pakistan Government Bonds - Yields Curve The Pakistan 10Y Government Bond has a 13.036% yield. Central Bank Rate is 15.00% (last modification in July 2022). The Pakistan credit rating is B-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 505.92 and implied probability of default is 8.43%.

Solved The Yield To Maturity On One Year Zero Coupon Bond Chegg The yield to maturity (ytm) on 1 year zero coupon bonds is 4% and the ytm on 2 year zeros is 6%. the yield to maturity on 2 year maturity the yield to maturity: a.) that is expected will be realized any time a bond issold. b.) will exceed the coupon tate when the bond is selling. Solved The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg,

What to Do When Your Savings Bond Reaches Maturity - The Motley Fool As of November 2021, the I bond rate is 7.12%. Series EE savings bonds also mature after 30 years. Like I bonds, they will earn interest until they are redeemed. Series EE bonds differ from I ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi-annually throughout the duration, or at the end of each fraction of a half-year for any fractional years ...

How to Calculate Holding Period Return - The Motley Fool Annualized holding period return. Note that "t" represents the time in years expressed in your holding period return. In other words, if you have a holding period return that covers 10 years, you ...

› knowledge › yield-toYield to Maturity (YTM): Formula and Calculator [Excel Template] Semi-Annual Coupon Rate (%) = 6.0% ÷ 2 = 3.0%; Then, we must calculate the number of compounding periods by multiplying the number of years to maturity by the number of payments made per year. Number of Compounding Periods (n) = 10 × 2 = 20; As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to ...

Factsheet | CITSP ZERO Perpetual Pref (SGD) - Retail - Fundsupermart.com Bond Charges, 0.35% of nominal value for each buy/sell order, subject to a minimum of SGD10 (or in its equivalent currency). Processing Fee, 0.05% per quarter, calculated on a daily average market value of bonds. Platform Fee, Bond Calculator, Nominal Value, Buy at, Market Order, SGD, What You Pay, 0.00, Indicative Accrued Interest (SGD) 10.00,

› bond-yield-calculatorBond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below:

FIN 221 Flashcards | Quizlet How can you calculate the future value at year n of a stream of uneven cash flows more rapidly on your financial calculator without finding the FV of each individual CF? ... A 20-year zero coupon bond. ... They pay a $65 annual coupon and have a 15-year maturity, but they can be called in 5 years at $1,100. What is their yield to maturity (YTM

Australia Government Bonds - Yields Curve The Australia 10Y Government Bond has a 3.566% yield.. 10 Years vs 2 Years bond spread is 52.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.35% (last modification in September 2022).. The Australia credit rating is AAA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 27.60 and implied probability of default is 0.46%.

Post a Comment for "38 zero coupon bond semi annual calculator"