44 ytm zero coupon bond

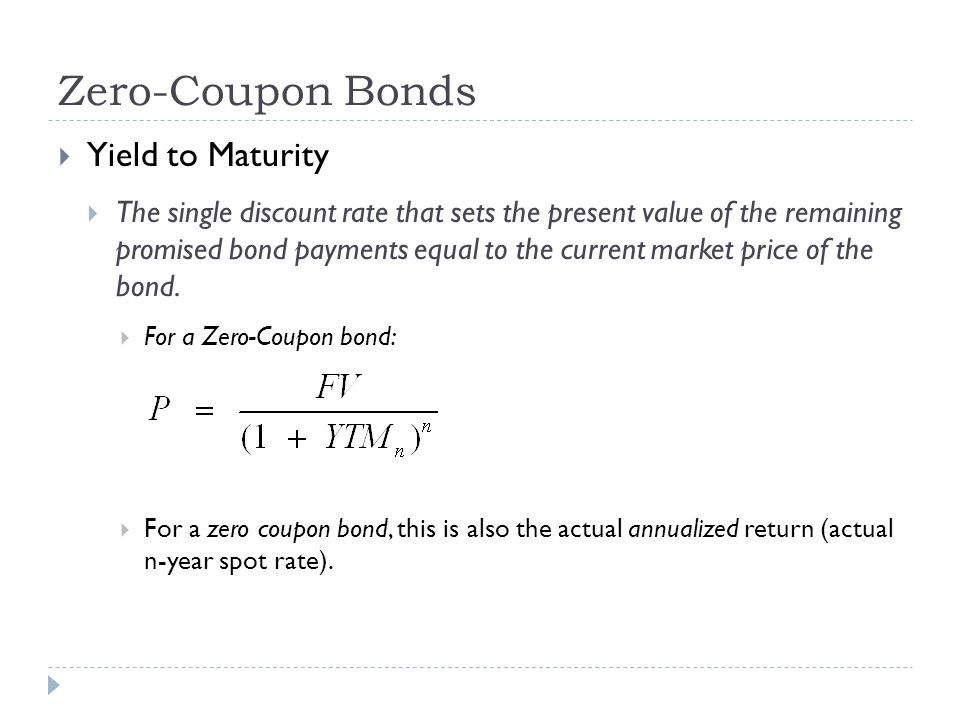

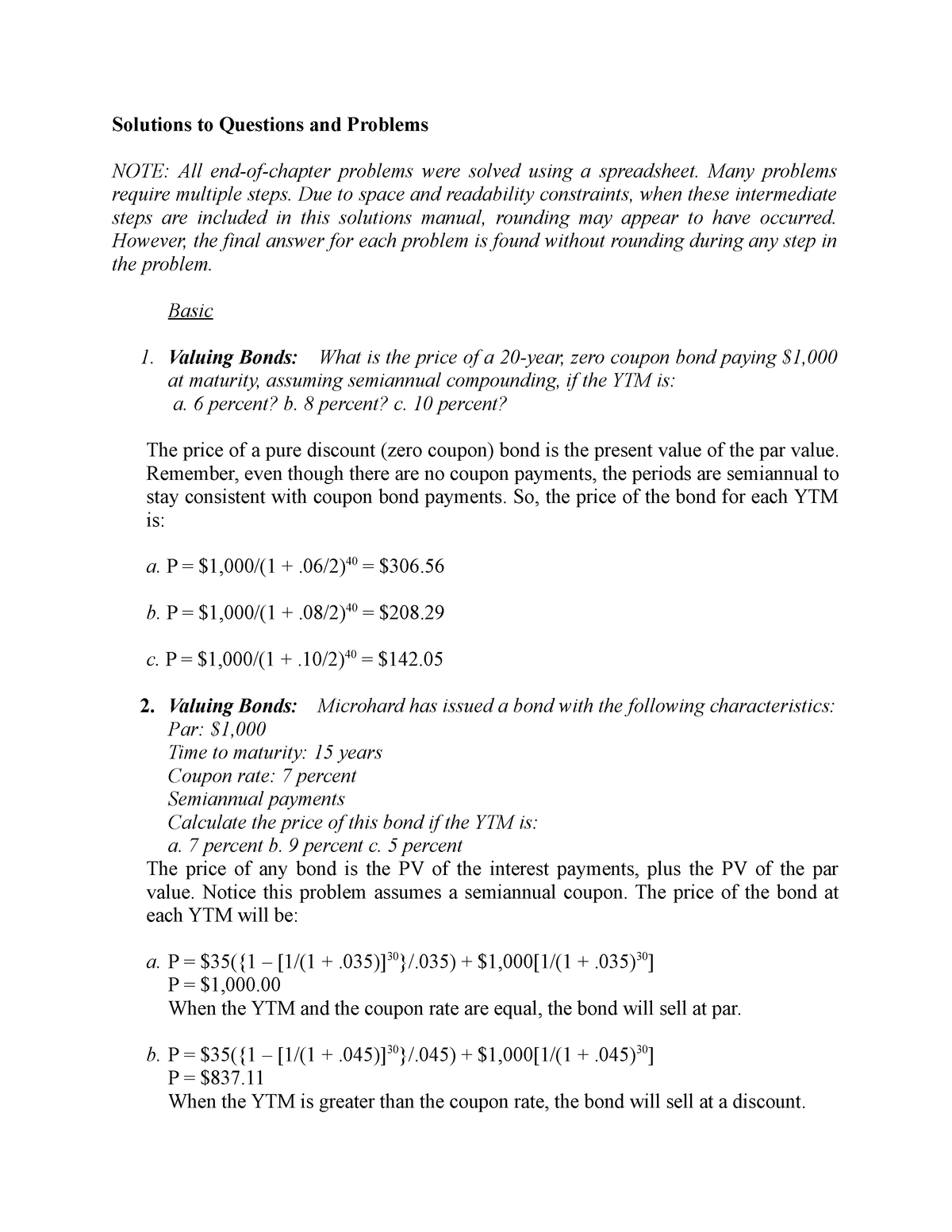

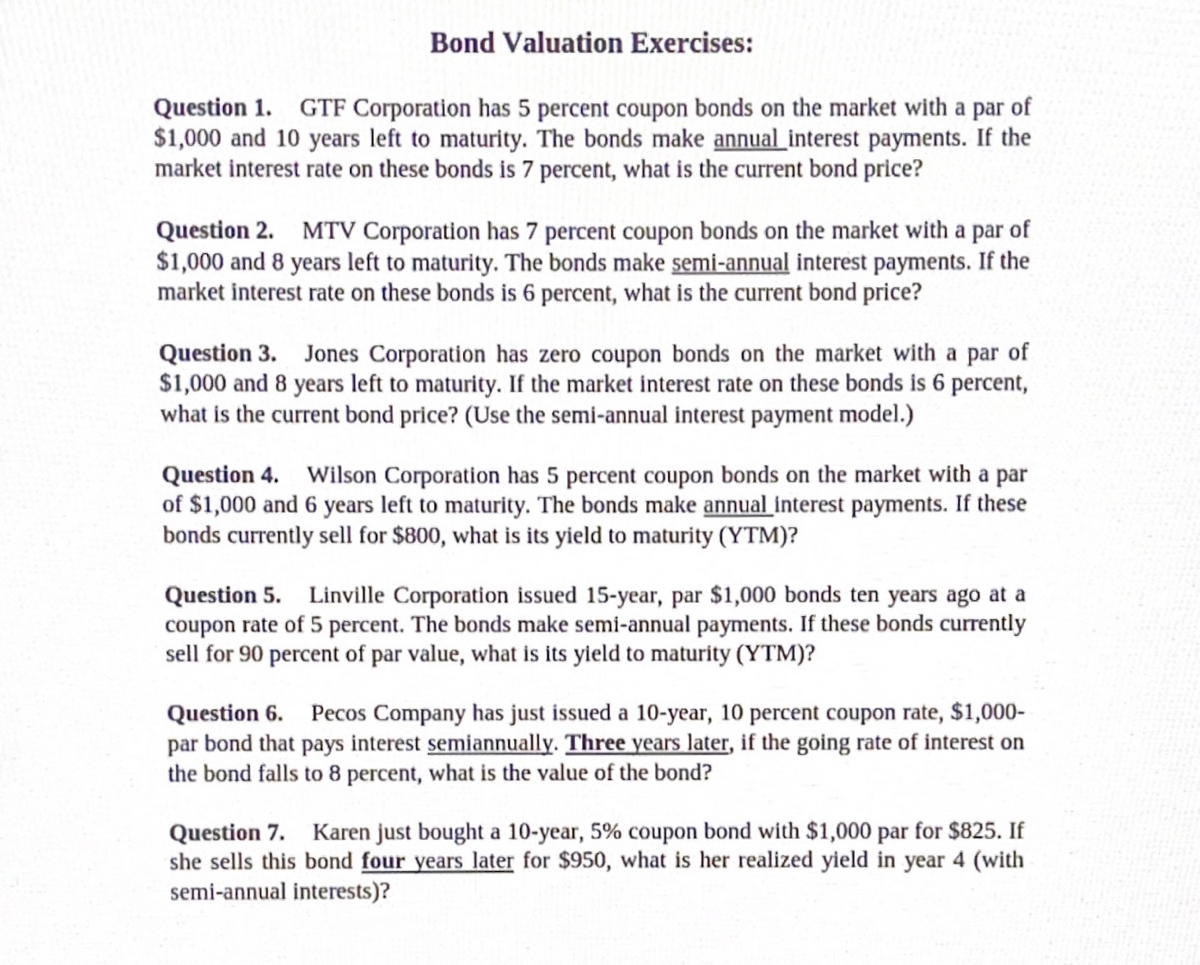

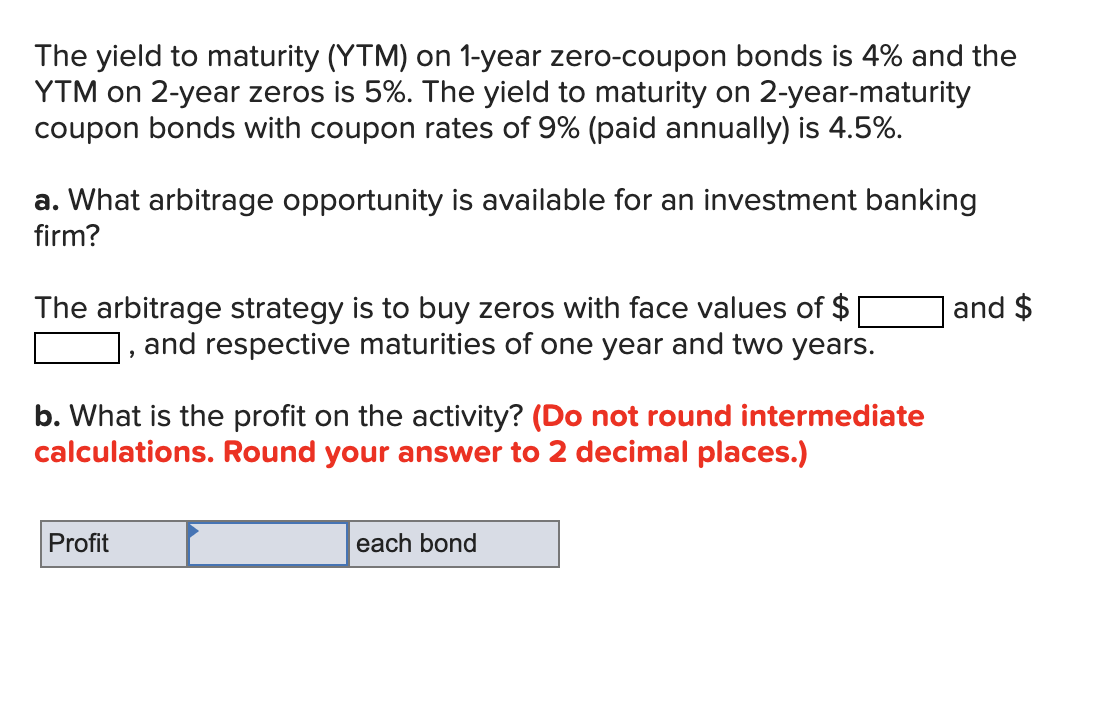

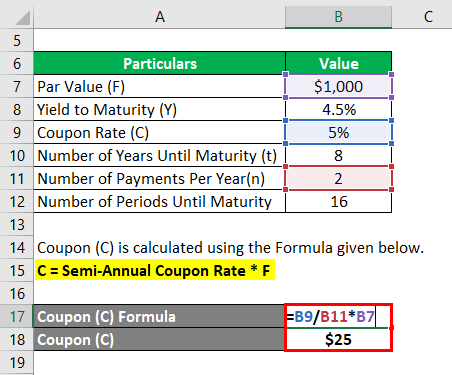

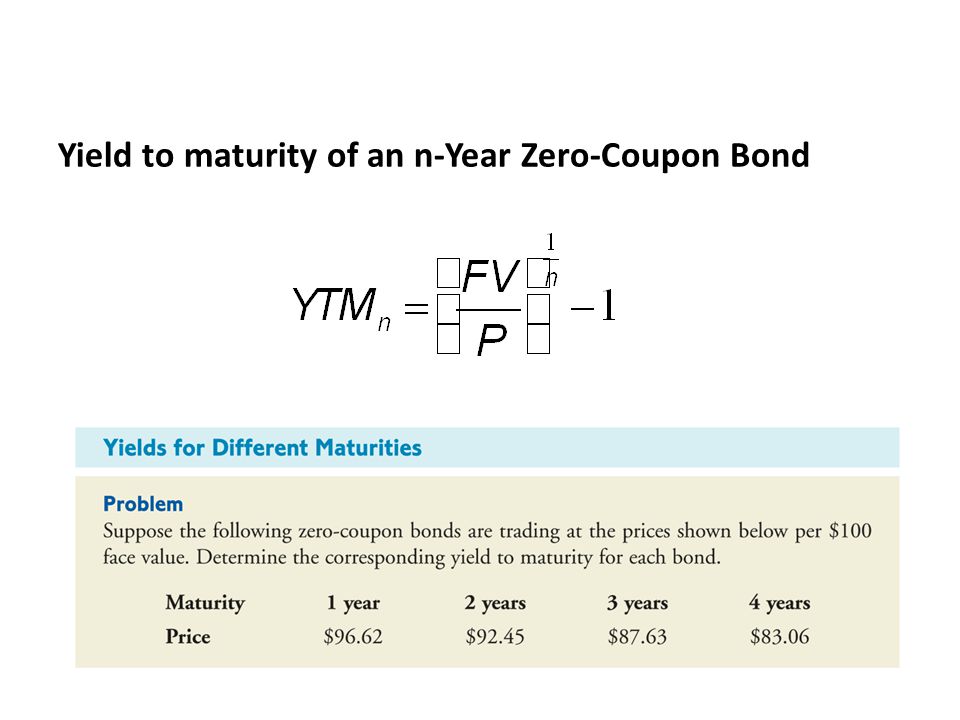

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that …

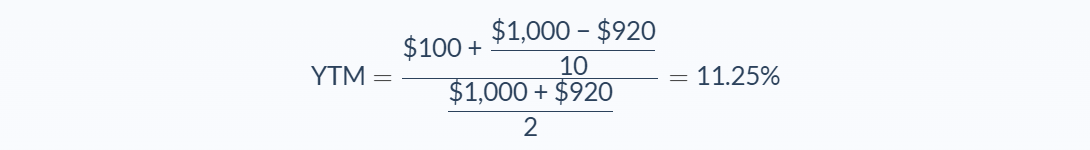

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · For example, if interest rates go up, driving the price of IBM's bond down to $980, the 2% coupon on the bond will remain unchanged. When a bond sells for more than its face value, it sells at a ...

Ytm zero coupon bond

Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31.5.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. Bond Duration Calculator – Macaulay and Modified Duration YTM: The calculated yield to maturity of the bond; Annual Payments: How many coupon payments the bond makes a year; Example: Compute the Modified Duration for a Bond. Let's extend the above example (from the Macaulay section) for a bond with the following characteristics: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to ...

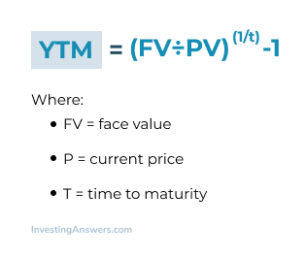

Ytm zero coupon bond. › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... › bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, … investinganswers.com › dictionary › yYield to Maturity (YTM) Definition & Example | InvestingAnswers Mar 10, 2021 · The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we’ll use the formula mentioned above: The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a coupon rate.

Bond Formula | How to Calculate a Bond | Examples with Excel … Zero-Coupon Bond Price = F / (1 + (r / n) ) n*t. Examples of Bond Formula (With Excel Template) ... Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Solution: Bond Price is calculated using the formula given below. en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. For zero-coupon bonds selling at a discount, the ... dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Yield to Maturity vs. Coupon Rate: What's the Difference? 20.5.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Current yield - Wikipedia The current yield, interest yield, income yield, flat yield, market yield, mark to market yield or running yield is a financial term used in reference to bonds and other fixed-interest securities such as gilts.It is the ratio of the annual interest payment and the bond's price: =. According to Investopedia, the clean market price of the bond should be the denominator in this calculation. Yield to Maturity (YTM) Definition & Example | InvestingAnswers 10.3.2021 · The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we’ll use the formula mentioned above: The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don’t have recurring interest payments, they don’t have a coupon rate. The zero coupon bond ... Bond Duration Calculator – Macaulay and Modified Duration YTM: The calculated yield to maturity of the bond; Annual Payments: How many coupon payments the bond makes a year; Example: Compute the Modified Duration for a Bond. Let's extend the above example (from the Macaulay section) for a bond with the following characteristics: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to ... › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years.

Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31.5.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/13-Figure2-1.png)

Post a Comment for "44 ytm zero coupon bond"