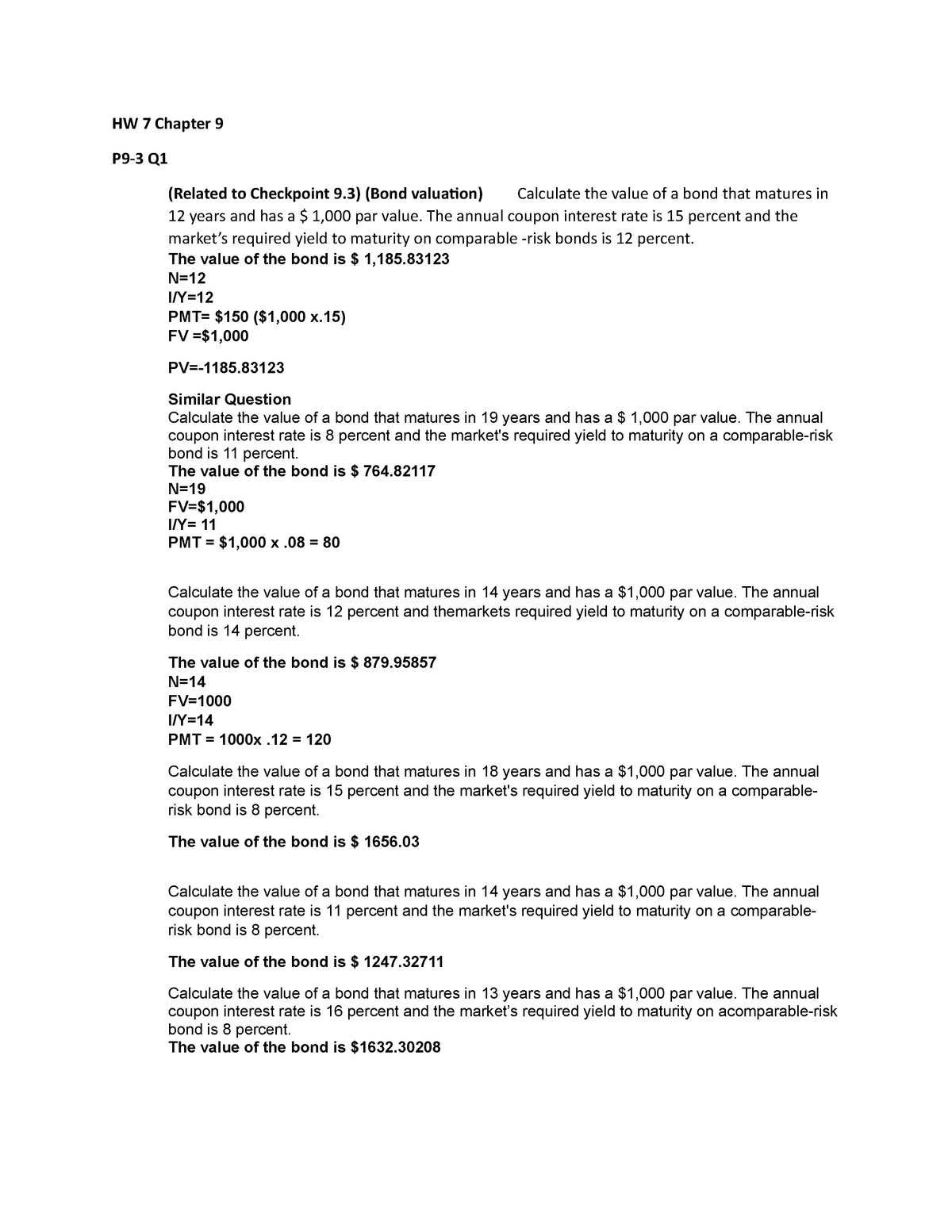

38 a 10 year bond with a 9 annual coupon

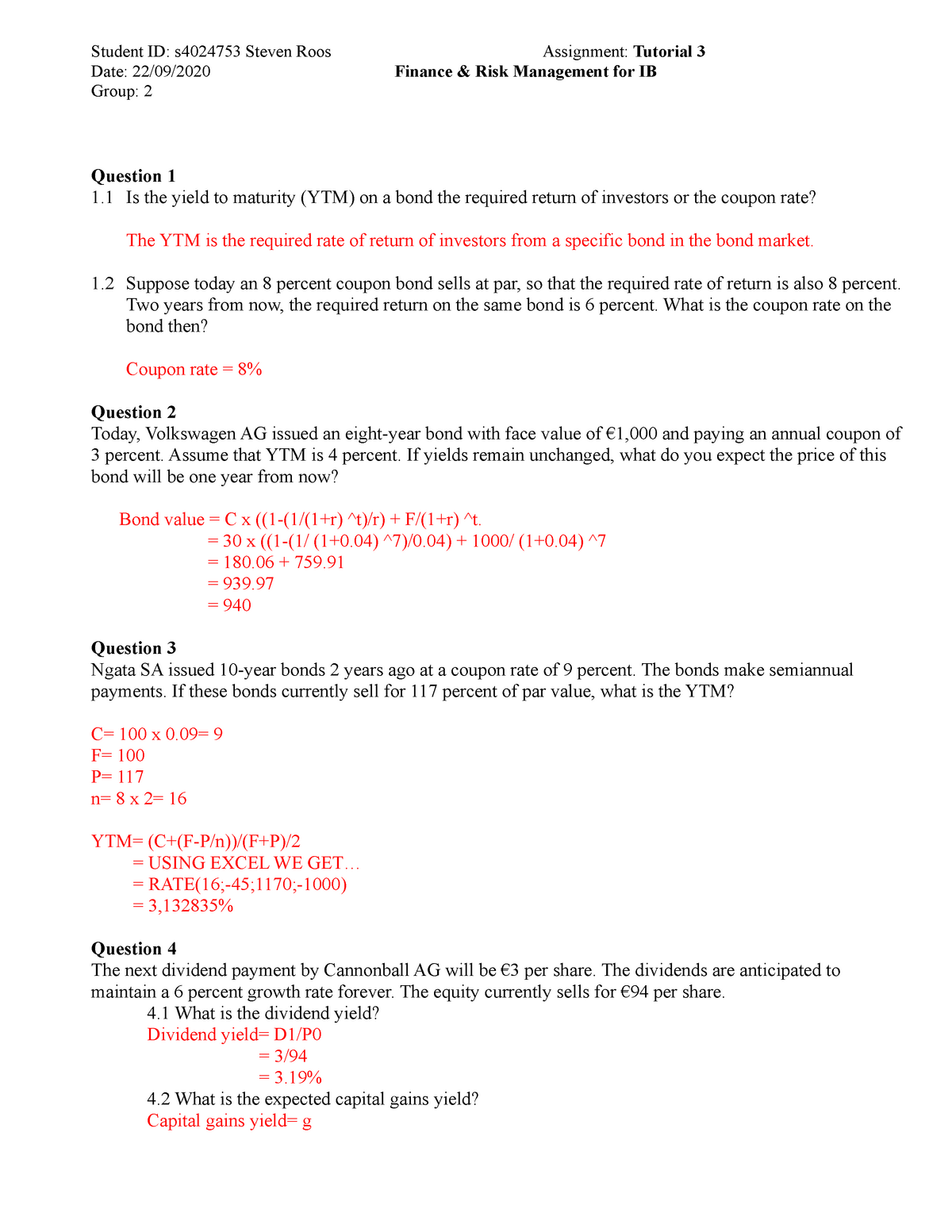

21 a 10 year bond with a 9 annual coupon has a yield 23. An investor is considering buying one of two 10-year, $1,000 face value, noncallable bonds: Bond A has a 7% annual coupon, while Bond B has a 9% annual coupon. Both bonds have a yield to maturity of 8%, and the YTM is expected to remain constant for the next 10 years. FINN 3226 CH. 4 Flashcards | Quizlet The bond's coupon rate is less than 8%. A A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

Chapter 7 Homework Finance Flashcards | Quizlet Bond A has a 9% annual coupon, while Bond B has a 7% annual coupon. Both bonds have the same maturity, a face value of $1,000, an 8% yield to maturity, and are noncallable. Which of the following statements is CORRECT? a. Bond A's capital gains yield is greater than Bond B's capital gains yield. b.

A 10 year bond with a 9 annual coupon

[Solved]: Suppose a 10 year $1000 bond with a 8.9% coupon ra Suppose a 10 year $1000 bond with a 8.9% coupon rate and semi annual coupons is trading for $1035.95. a. What is a bond yield to maturity expressed as an APR with semi annual compounding? b. If the bonds yield to maturity changes to 9.2% a PR, what will be the bonds price? Answered: A 10-year bond with a 9% annual coupon… | bartleby Business Finance Q&A Library A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%. What is the yield to maturity for a 3 year bond with a 10% annual ... So in this question, we have to find to maturity for a 3 ear bond with 10 per cent canal coupon. If the bond is trading at per se, the bond is trading at per when its when it's all to metiority is equal to equal to his coupons. So to maturity is equal to coupe, which is equal to 10 percent. So we can write. Hncefieled to maturity is 10 percent.

A 10 year bond with a 9 annual coupon. Answered: A 20-year, 15% semi-annual coupon bond… | bartleby ASK AN EXPERT. Business Finance A 20-year, 15% semi-annual coupon bond with a R1,000 par value bond is selling for R1,245 with a 10% yield to maturity. It can be called after five years at R1,020. Calculate the yield to call. A 20-year, 15% semi-annual coupon bond with a R1,000 par value bond is selling for R1,245 with a 10% yield to maturity. Consider a 10-year bond with annual coupon rate 8%. Suppose...get 5 Therefore, 10-year returnis 8.57%. e. The desired bond's YTM influences the 10-year return, If the YTM is more, the 10 year return is likely to be more. However, the 10-year return is also dependent on the movement of term structure. If the interest rates increase, the coupons are reinvested at a higher rate and 10-year return increases beyond YTM. Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. Answered: A 10-year bond with a 9% annual coupon… | bartleby A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Group of answer choices If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond is selling at a discount.

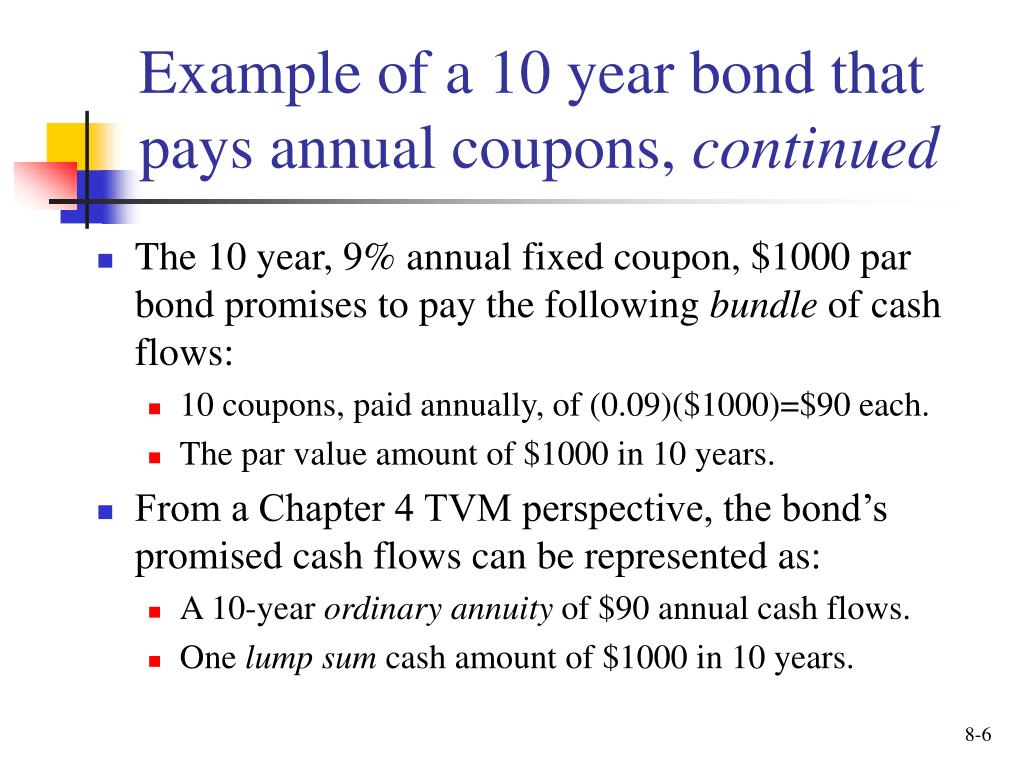

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Mid Term : Ch 6 Flashcards | Quizlet A bond is priced at $1,100, has 10 years remaining until maturity, and has a 10% coupon, paid semiannually. What is the amount of the next interest payment? A) $50 B) $55 C) $110 D) $100 A) $50 What is the amount of the annual coupon payment for a bond that has 6 years until maturity, sells for $1,050, and has a yield to maturity of 9.37%? What is the value of a 10-year, $1,000 par value bond with a 10 ... - Quora When you buy a bond for, say $1000, and the coupon rate is 10% for 10 years, paying you $100 per year. Where is the profit in that? You get the $1000 back at maturity. So you collect $100 of interest for 10 years and receive $1000 of principal at maturity. So you collect a total of $2000 for your $1000 investment. 14 Lawrence Schneider Solved A 10-year bond with a 9% annual coupon has a yield to ... See the answer A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value Expert Answer

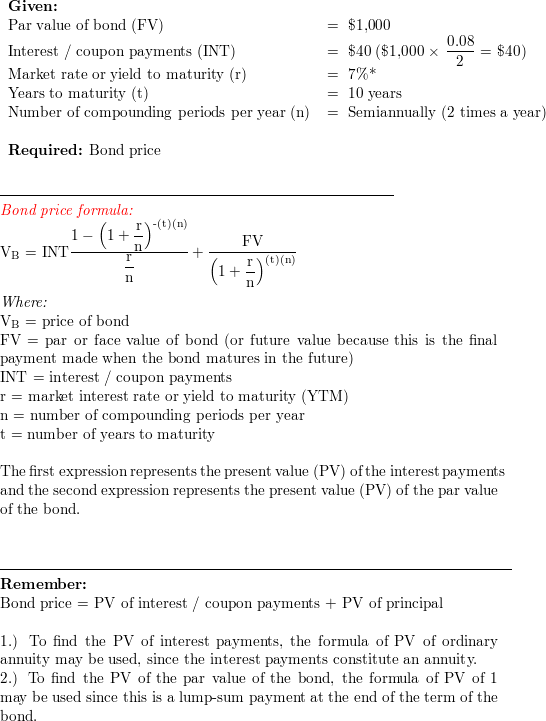

Answered: A 1,000 par value 34-year bond with 9%… | bartleby Homework help starts here! Business Finance A 1,000 par value 34-year bond with 9% annual coupons is bought at a price to yield an annual effective rate of 4%. Calculate the interest portion of the 14th coupon. A 1,000 par value 34-year bond with 9% annual coupons is bought at a price to yield an annual effective rate of 4%. Solved A 10-year bond with a 9% annual coupon has a yield to ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

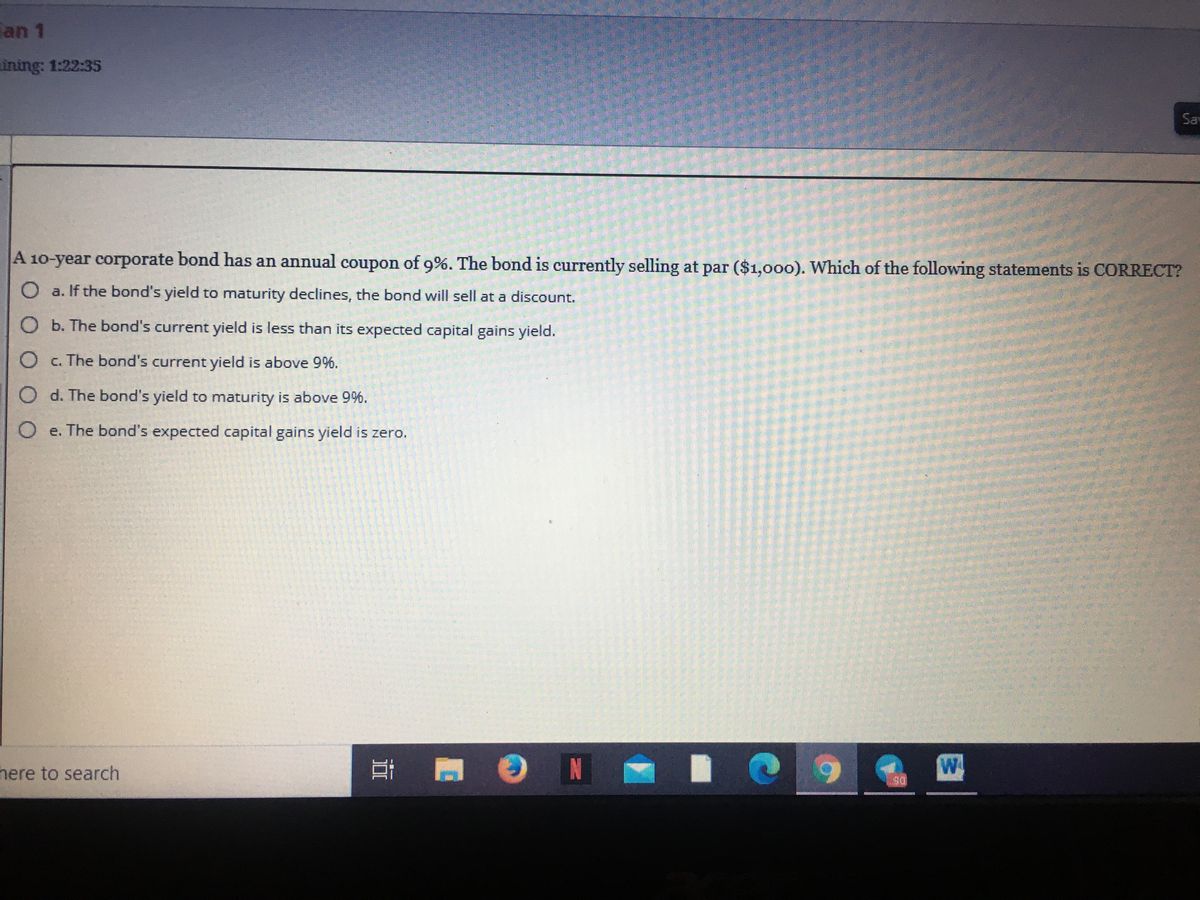

A 10 year corporate bond has an annual coupon of 9 A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is INCORRECT? a. The bond’s expected capital gains yield is positive. b. The bond’s yield to maturity is 9%. c. The bond’s current yield is 9%. d. The bond’s current yield exceeds its capital gains yield. ANS: A

Finance Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. The bond's current yield is greater than 9%. c.

A 10-year bond with a 9% annual coupon has a yield to ... Nov 28, 2019 · A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond’s price one year from now will be lower than its current price. d.

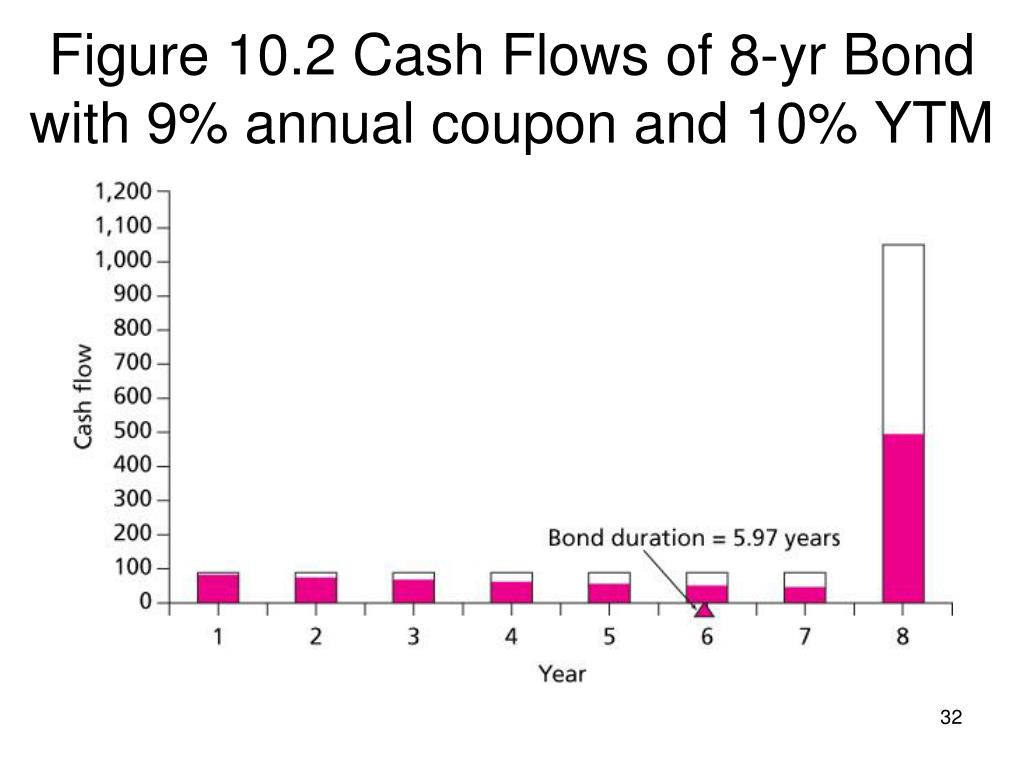

BONDS PRACTICE.pdf - 1. Consider each of the following... 1. Consider each of the following bonds: Bond A: 8-year maturity with a 7% annual coupon. Bond B: 10-year maturity with a 9% annual coupon. Bond C: 12-year maturity with a zero coupon. Each bond has a face value of $1,000 and a yield to maturity of 8%.

A 10 year bond with a 9 annual coupon has a yield to A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value.c. The bond is selling at a discount. d.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If...

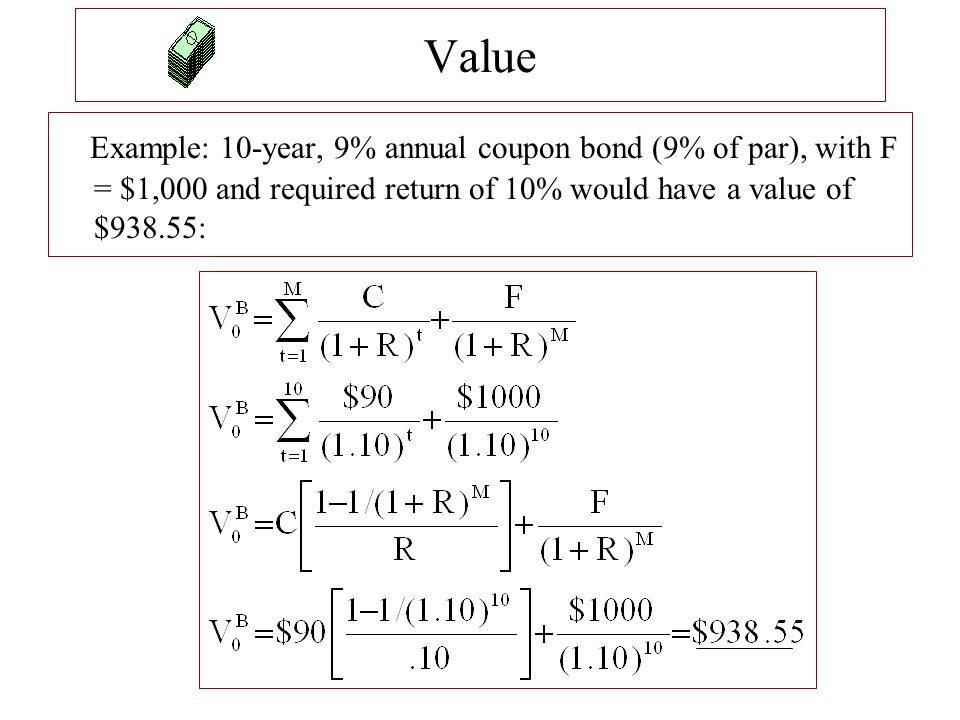

A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora Answer (1 of 3): We can use the formula for present value of annuity to calculate this. The formula is: Here P is the amount annually paid i.e. 80 (assuming nominal value of $1000), r is the required rate of return i.e. 7%(not coupon rate of 8%) and n is 10 years. Also, the above formula consid...

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year corporate bond has an annual coupon of 9%. The 3. A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is … read more JKCPA CPA Bachelor's Degree 844 satisfied customers 5. If a bank loan officer were considering a companys request 5.

Coupon Payment Calculator How to calculate bond coupon payment? Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.

Chapter 7 Finance 310 Flashcards | Quizlet If interest rates decline, the prices of both bonds would increase, but the 10-year bond would have a larger percentage increase in price. Correct Answer: A Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. The bond has a face value of $1,000, and it makes semiannual interest payments.

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

A 10 year bond with a 9 percent semiannual coupon is Answer: a . $ 689.08 84 . A 10 - year bond with a 9 percent semiannual coupon is currently selling at par . A 10 - year bond with a 9 percent annual coupon has the same risk , and therefore , the same effective annual return as the semiannual bond . If the annual coupon bond has a face value of $ 1,000 , what will be its price ? a . $ 987.12

What is the yield to maturity for a 3 year bond with a 10% annual ... So in this question, we have to find to maturity for a 3 ear bond with 10 per cent canal coupon. If the bond is trading at per se, the bond is trading at per when its when it's all to metiority is equal to equal to his coupons. So to maturity is equal to coupe, which is equal to 10 percent. So we can write. Hncefieled to maturity is 10 percent.

Answered: A 10-year bond with a 9% annual coupon… | bartleby Business Finance Q&A Library A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%.

[Solved]: Suppose a 10 year $1000 bond with a 8.9% coupon ra Suppose a 10 year $1000 bond with a 8.9% coupon rate and semi annual coupons is trading for $1035.95. a. What is a bond yield to maturity expressed as an APR with semi annual compounding? b. If the bonds yield to maturity changes to 9.2% a PR, what will be the bonds price?

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

Post a Comment for "38 a 10 year bond with a 9 annual coupon"