42 what is coupon payment of a bond

Bond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction. Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase price of the bond, its nominal return over its duration & its yield to maturity. Entering Years: For longer duration bonds enter the number of years to maturity.

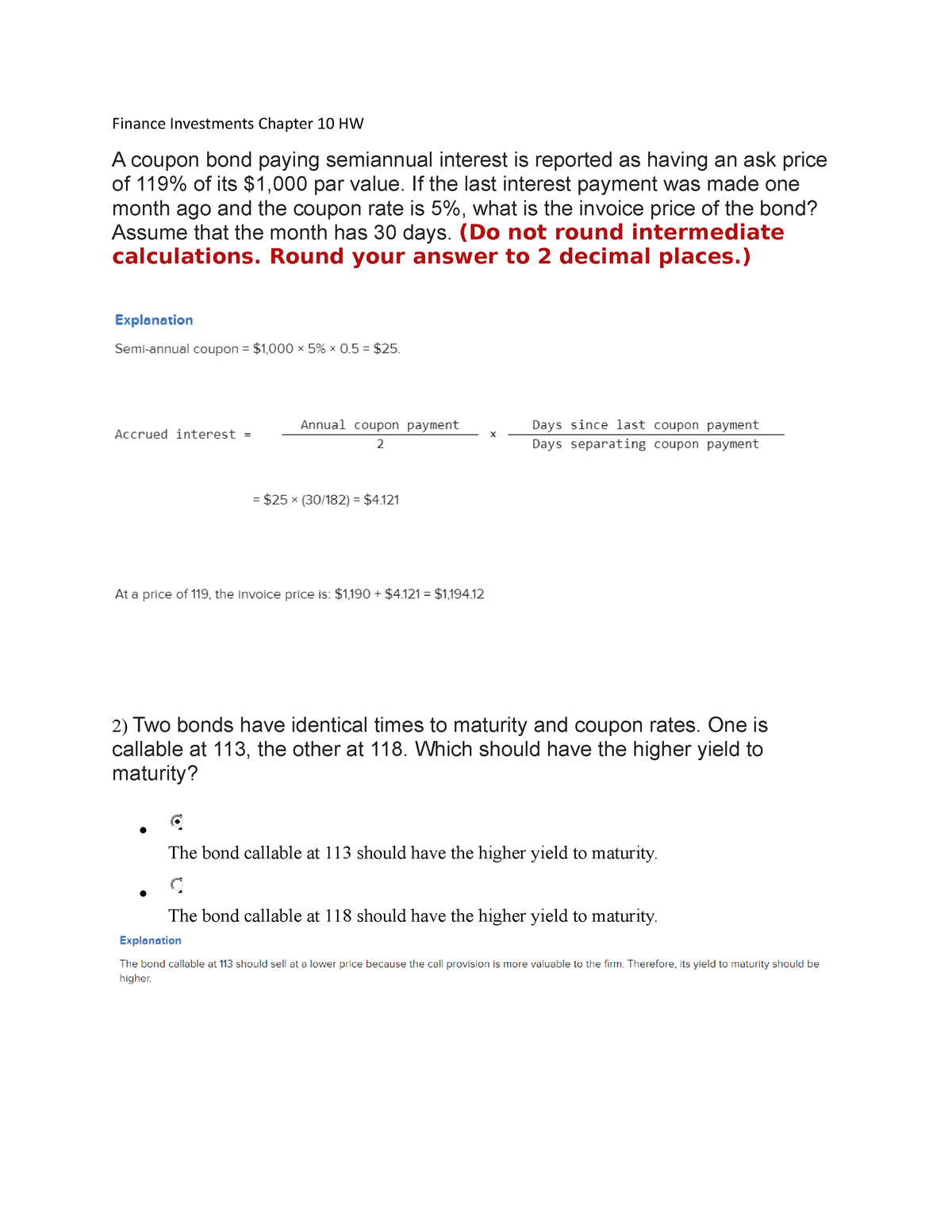

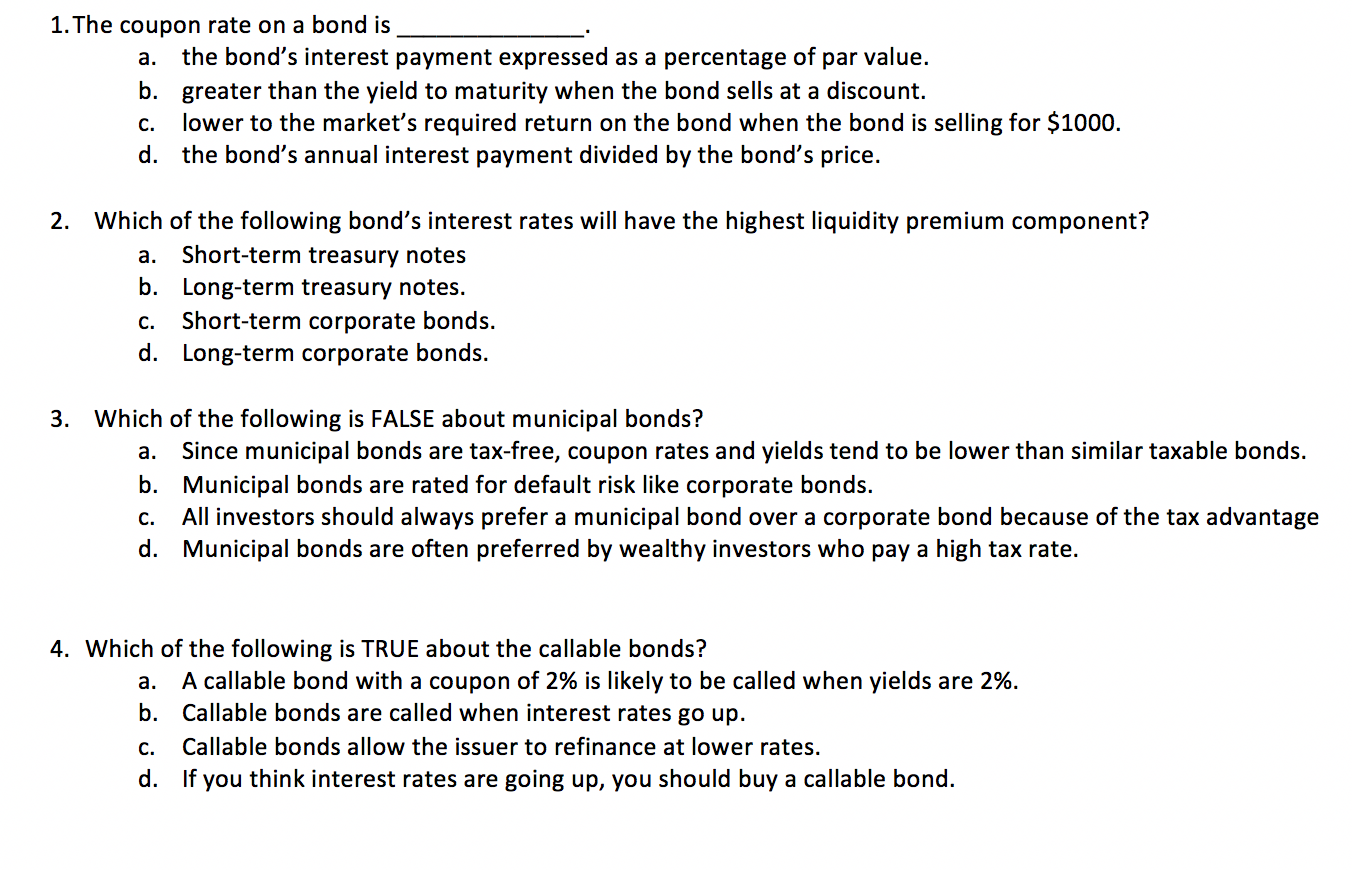

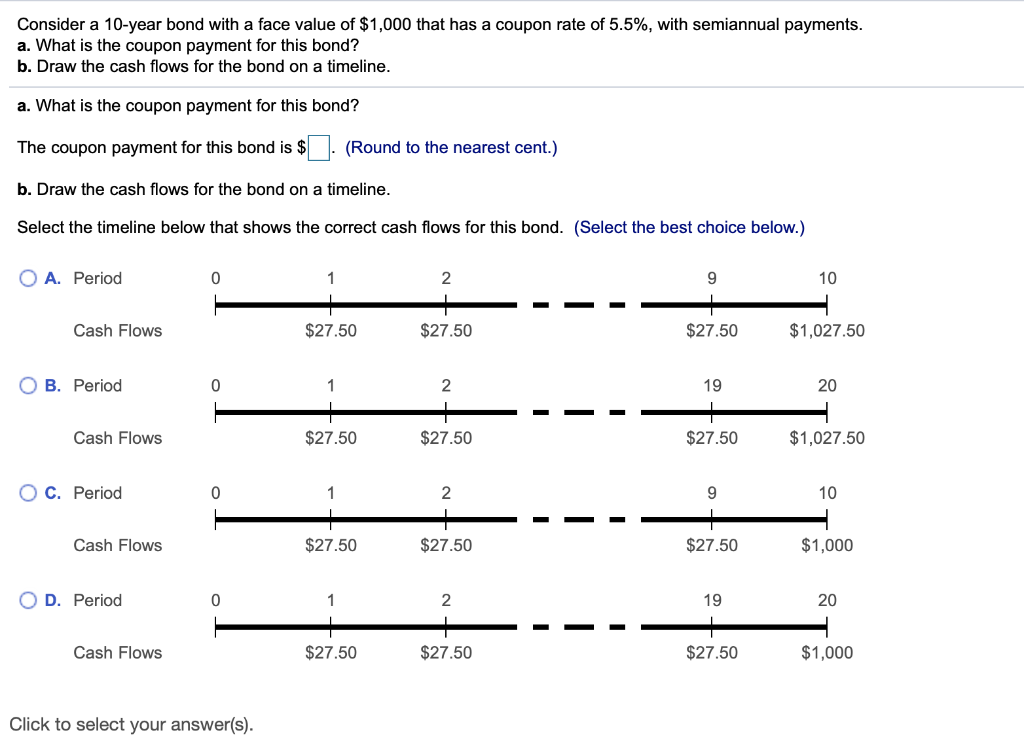

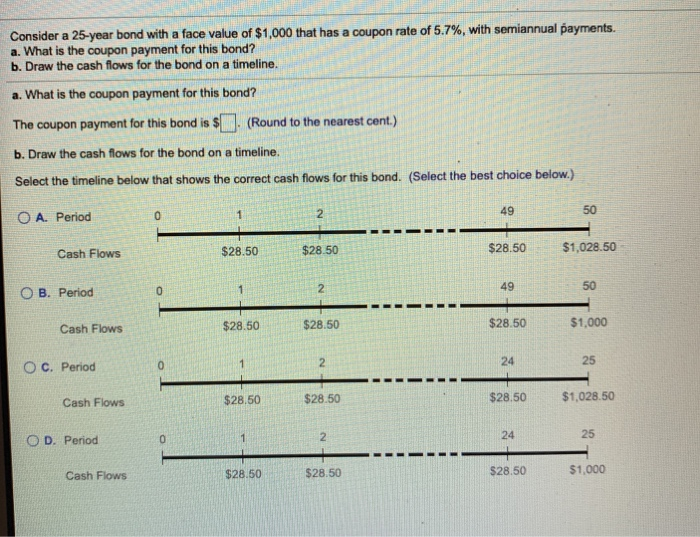

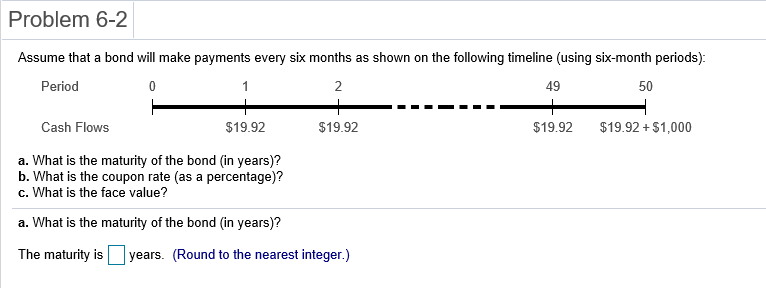

How to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. For example, you may see a 5% coupon on a bond with a face value of $1000. In this case, the coupon would be $50 (0.05 multiplied by $1000). It is important to remember the coupon is always an annual ...

What is coupon payment of a bond

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... The steps to calculate the coupon rate of a bond are the following: Firstly, the face value or par value of the bond issuance is determined as per the funding requirement of the company. Now, the number of interest paid during the year is determined, and then the annualized interest payment is calculated by adding up all the payments during the ...

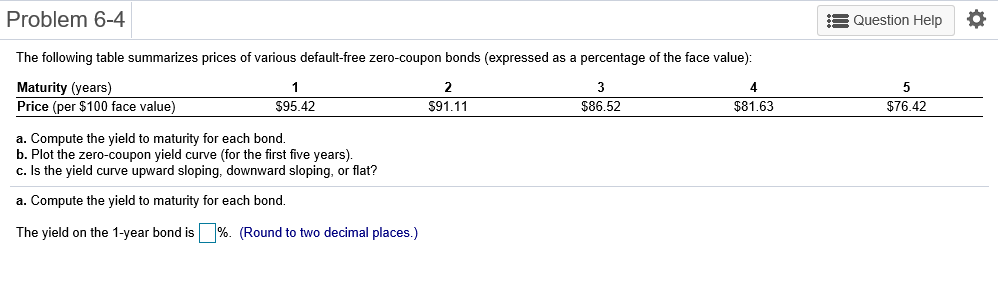

What is coupon payment of a bond. What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... The steps to calculate the coupon rate of a bond are the following: Firstly, the face value or par value of the bond issuance is determined as per the funding requirement of the company. Now, the number of interest paid during the year is determined, and then the annualized interest payment is calculated by adding up all the payments during the ... Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 what is coupon payment of a bond"