43 the coupon rate of a bond is equal to

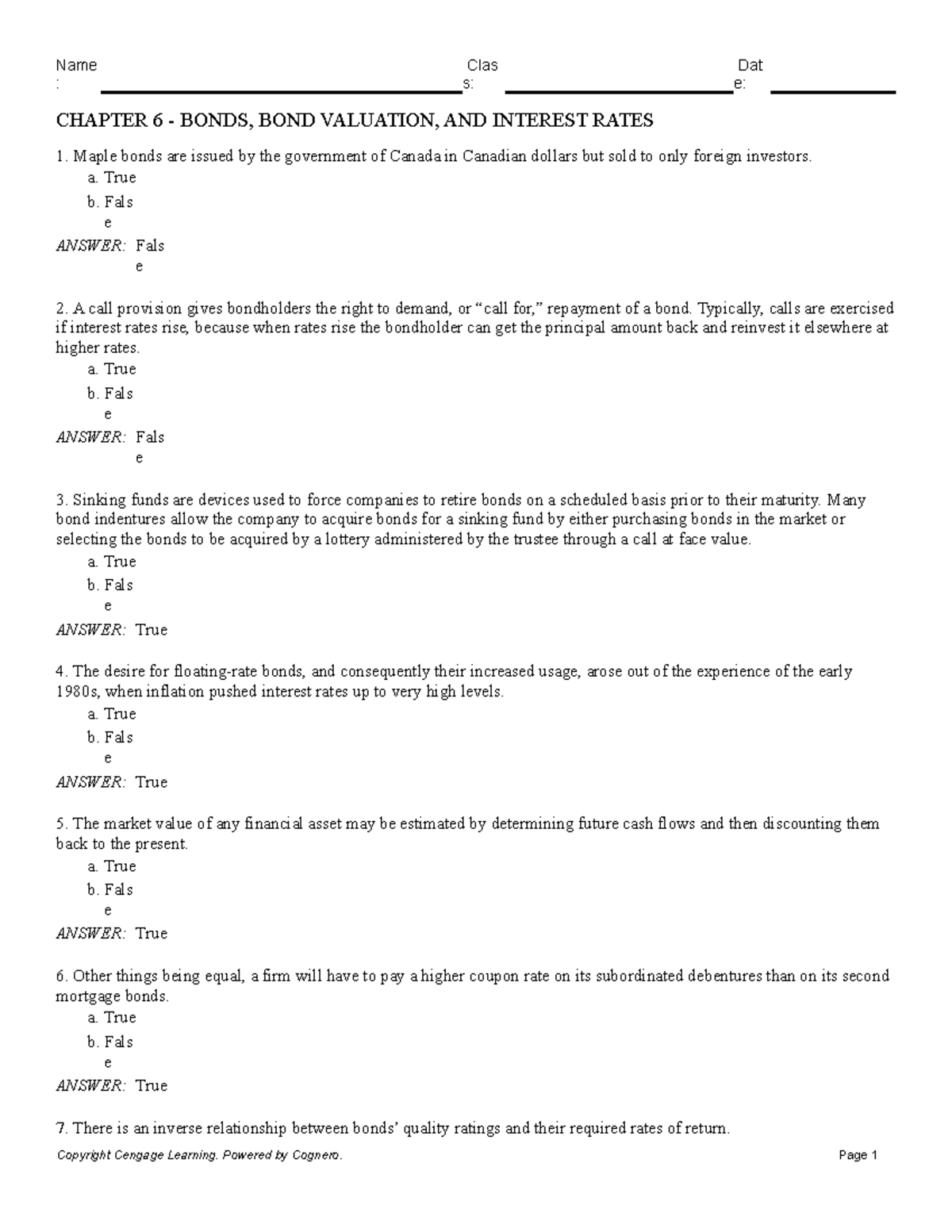

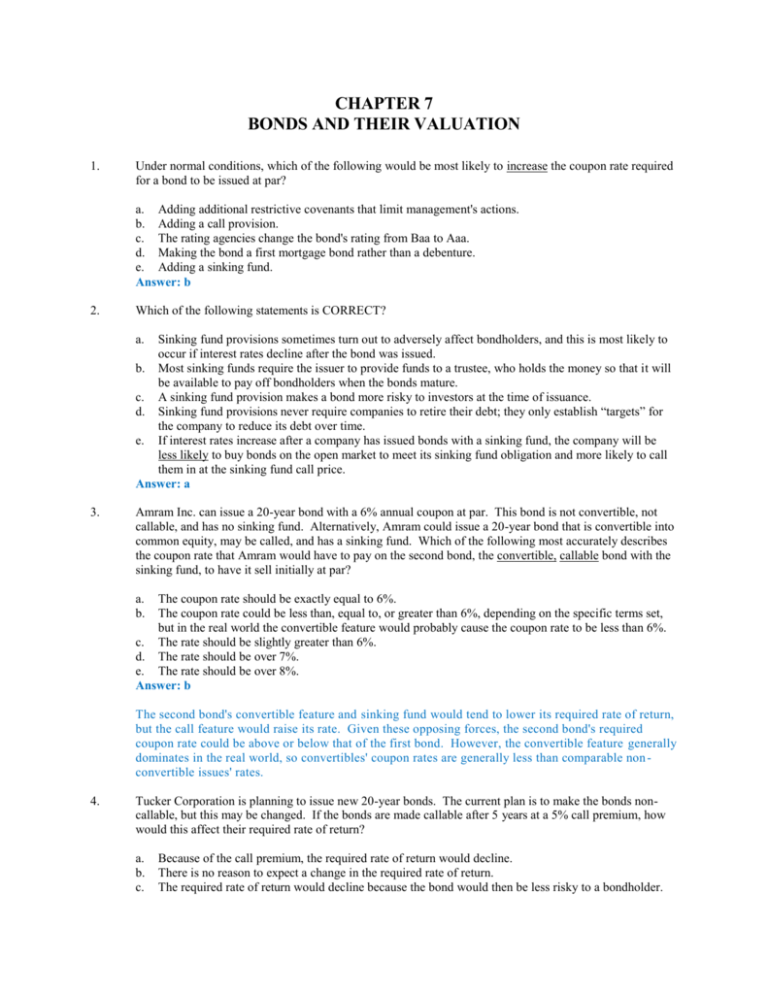

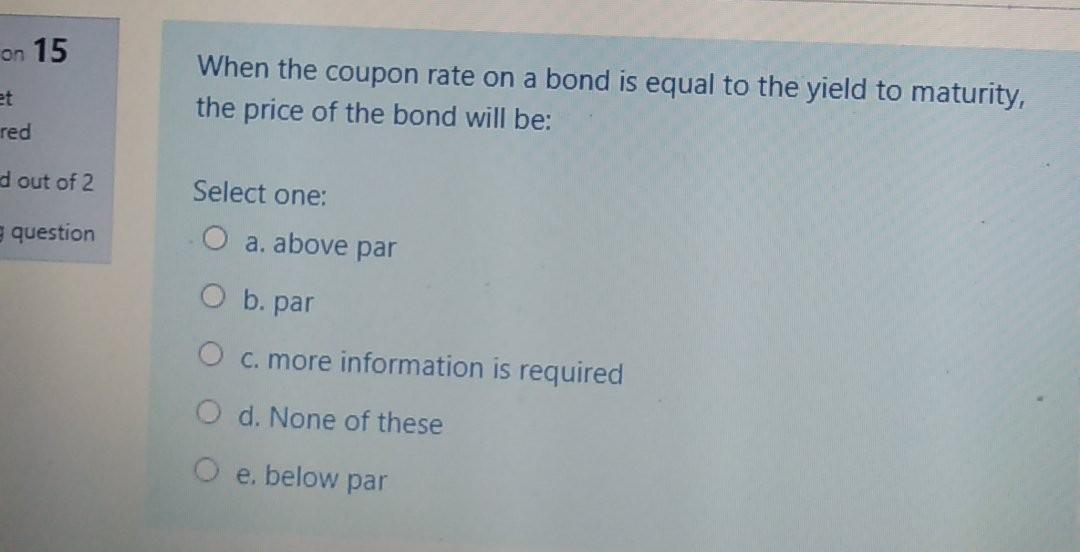

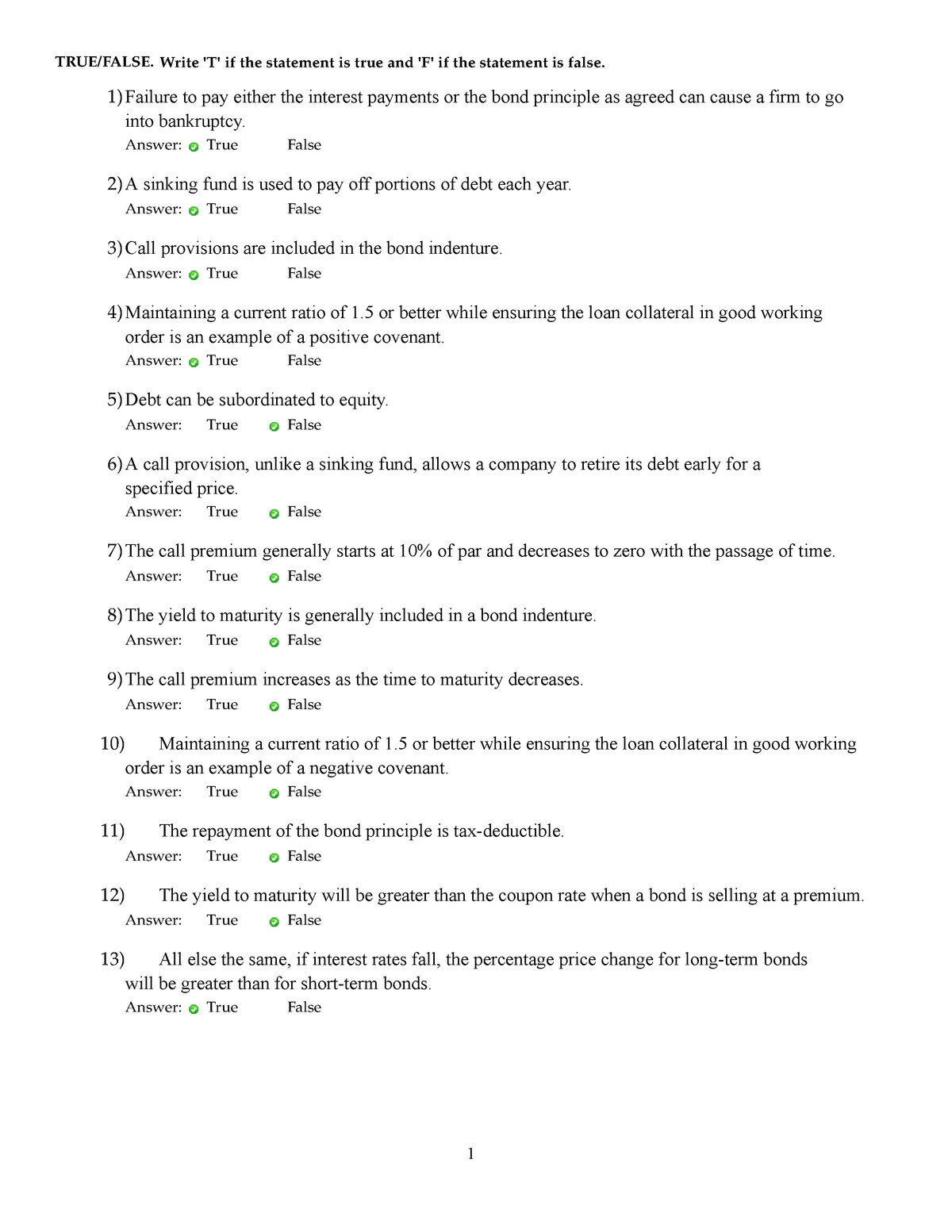

Bond valuation Flashcards | Quizlet When the bond's coupon rate is greater than the bondholder's required return, the bond's intrinsic value will __ its par value, and the bond will trade at a premium. When the bond's coupon rate is less than the bondholder's required return, the bond's intrinsic value will be less than its par value, and the bond will trade at__ exceed, a discount Difference Between Coupon Rate and Discount Rate Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. Loan Process If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond.

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) A bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate Formula. Here we learn how to calculate the Coupon Rate of the Bond using practical examples and a downloadable excel template. You can learn more about Accounting from the following articles –

The coupon rate of a bond is equal to

FINANCE - Module 7 Flashcards | Quizlet A. a 15-year bond with a notional value of $5000 and a coupon rate of 5% paid quarterly B. a 15-year bond with a notional value of $5000 and a coupon rate of 1.25% paid annually C. a 30-year bond with a notional value of $5000 and a coupon rate of 3.75% paid semiannually Coupon Bond - Guide, Examples, How Coupon Bonds Work Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate i = Interest rate n = number of payments Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

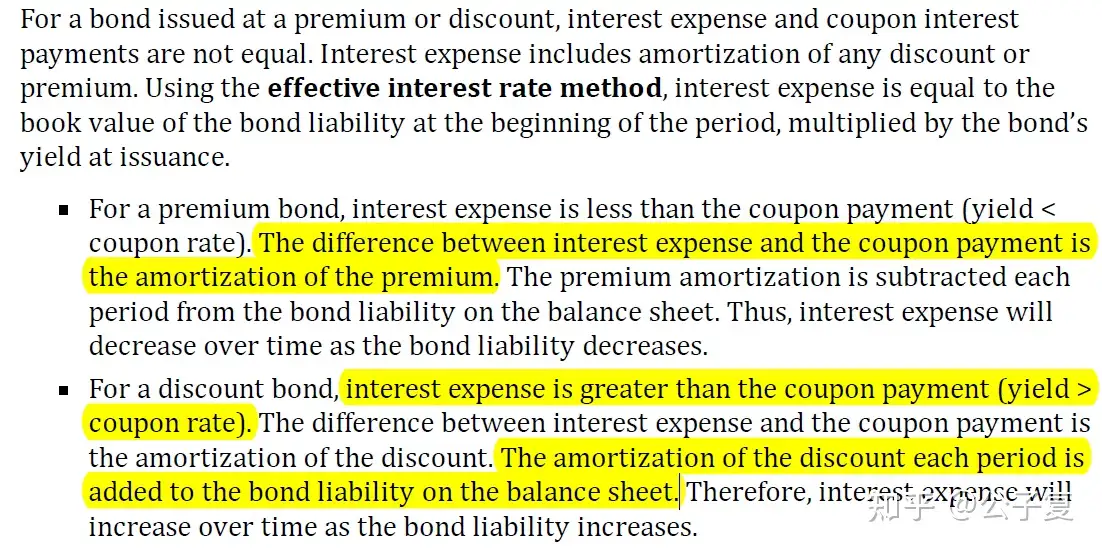

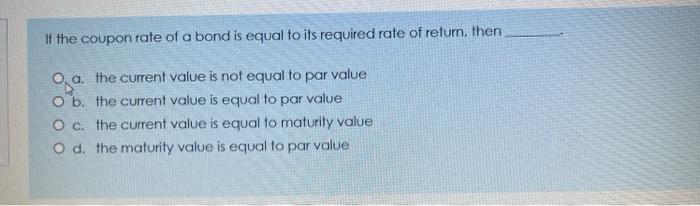

The coupon rate of a bond is equal to. › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The bond price varies based on the coupon rate and the prevailing market rate of interest. If the coupon rate is lower than the market interest rate, then the bond is said to be traded at a discount, while the bond is said to be traded at a premium if the coupon rate is higher than the market interest rate. Business Finance Ch. 6 Flashcards | Quizlet Coupon Rate Which of the following terms apply to a bond? a fixed amount of interest that is paid annually or semiannually by the issuer to its bondholders A bonds coupon payment is: it is known as the par value and is the principal amount repaid at maturity Which of the following are true about a bond's face value? Increases Chapter six: bonds Flashcards | Quizlet Percentage rate of return on a bond = Current yield + Coupon rate of interest b. Percentage rate of return on a bond = Current yield + Capital gains yield c. Percentage rate of return on a bond = Market return + Maturity value d. Percentage rate of return on a bond = Market yield + Current yield e. When the coupon rate of a bond is equal to the - Course Hero When the coupon rate of a bond is equal to the current interest rate, the bond will sell for face value. The discount rate that makes the present value of the bond's payments equal to its price is known as the yield to maturity. yield to maturity . Motor's Corporation sold 6 year bonds for $1,072.62, with a face value of $1,000 and a coupon ...

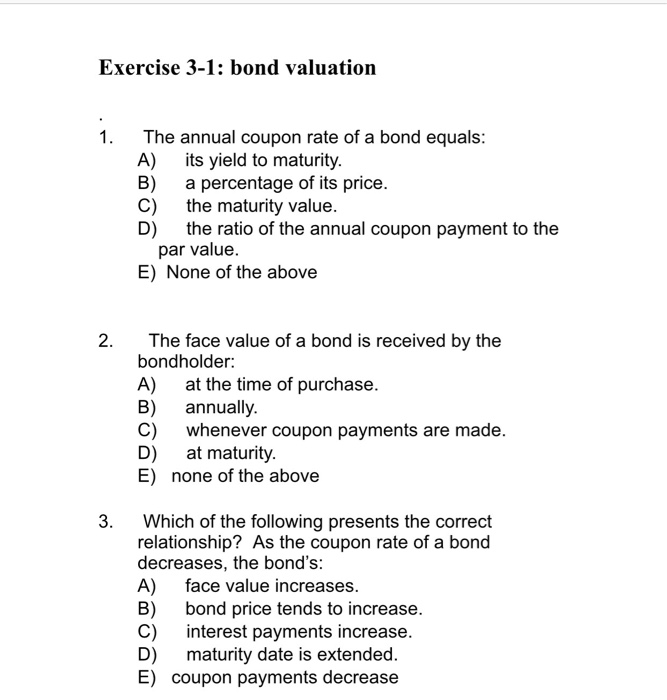

A discount bonds coupon rate is equal to the annual - Course Hero 13- A discount bond's coupon rate is equal to the annual interest divided by the: Multiple Choice clean price. current price. dirty price. face value. call price. Multiple Choice clean price . 14- Yan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.4 percent paid semiannually and 13 years to maturity. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder. Chapter 8 - Bond Valuation & Risk Flashcards | Quizlet The valuation of bonds is generally perceived to be ____ the valuation of equity securities. easier than. If the coupon rate equals the required rate of return, the price of the bond. should be equal to its par value. If the coupon rate ____ the required rate of return, the price of a bond ____ par value. equals; equals. What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

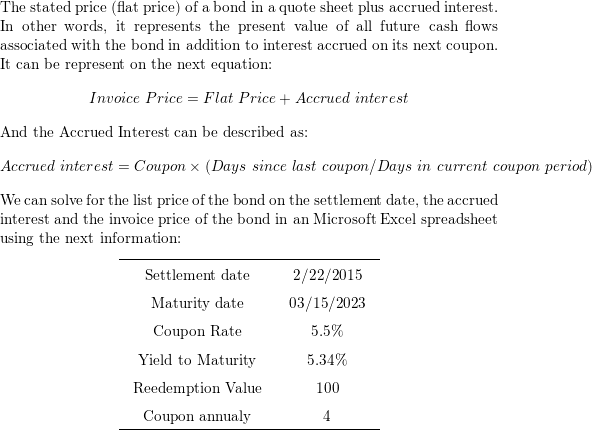

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. A discount bonds coupon rate is equal to the annual - Course Hero 62)A discount bond's coupon rate is equal to the annual interest divided by the: 62) A) call price. B)clean price. C)current price. D)dirty price. E)face value. 63)The pure time value of money is known as the: 63) A) inflation factor. B)Fisher effect. C)term structure of interest rates. D)liquidity effect. E)interest rate factor. C . Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] Coupon Bond - Guide, Examples, How Coupon Bonds Work Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate i = Interest rate n = number of payments

FINANCE - Module 7 Flashcards | Quizlet A. a 15-year bond with a notional value of $5000 and a coupon rate of 5% paid quarterly B. a 15-year bond with a notional value of $5000 and a coupon rate of 1.25% paid annually C. a 30-year bond with a notional value of $5000 and a coupon rate of 3.75% paid semiannually

Post a Comment for "43 the coupon rate of a bond is equal to"